Capacity of energy supply in China is going to be surplus. Significant supply shortages of fuel or electricity were frequently seen during past high demand seasons in the country. It was the adverse effect of the fast growth of economy. Although growth of petroleum demand has been slowing down apparently in a past couple of years, new refining facilities are installed based on the forecast that the demand would continue to increase on the previous pace.

Total crude oil processing capacity in China was estimated at 10.8 million barrels per day as of end-2011. It had increased to 11.5 million bpd a year later. Currently the country seems to have 12.3 million bpd of crude oil processing capacity. Utilization rate of the refineries were nearly 90% in late 2011 and late 2012. But it might have been decreasing to below 80% at moment.

Crude oil processed in November fell 0.6% from a year ago to 9.81 million bpd, according to the National Bureau of Statistics of China. It was the second time year-on-year decrease in this year.

Many organizations are estimating Chinese petroleum demand. But some of those numbers might have been overestimated.

Monthly Chinese petroleum demand figures estimated by the United States Energy Information Administration have exceeded the 10 million bpd level consecutively since April 2012. However, monthly apparent petroleum demand in China calculated by Platts have hovered below the level since March this year.

I am also calculating Chinese petroleum demand with considering a change of stockpile as well. The numbers are even lower than Platts, since stockpile of petroleum products are sometimes significantly risen when crude oil processing is increased.

The level of 10 million bpd seems to be a barrier against the growth of Chinese petroleum demand now. If refining facilities will be added by several percent from the previous year, utilization rate could sink to the middle of 70% level in 2014.

12.29.2013

12.22.2013

Energy outlook urges US crude oil exports

Crude oil production in the United States has risen to the 8 million barrels per day level from about 5 million bpd in mid-2000s due to the shale revolution. Recently, cancellation of the crude oil export ban is discussed aggressively. A long-term outlook for the energy released by the U.S. government is also seems to be revised in order to encourage such trend.

The U.S. Energy Information Administration recently announced an early release version of "Annual Energy Outlook 2014". The annual report is usually announced in the second quarter every year and its early release is published in the end of prior year.

The most remarkable change from the previous year's edition is significant upward revision of petroleum production. Although natural gas output is upward revised year by year, the change of petroleum production from the 2013 edition in this time is much noteworthy.

Meanwhile, forecasts for the demand of petroleum had been already drastically changed in the 2013 edition from the previous steady upward tendency to the gradual down trend. The down trend is amended further down in the latest edition. On the other hand, natural gas demand is consecutively upward revised every year.

The long term outlook might have be set based on the government's policy. The change of AEO 2013 edition suggests that the U.S. government has changed the country's main energy resource from petroleum to natural gas in 2012. The change in the 2014 edition seems to promote the cancellation of crude oil export ban as well.

Petroleum demand in the U.S. is seen to shrink long-term, while domestic crude oil production is predicted to raised. However, imports are likely to continue since the domestic supply is not able to cover the entire demand. Meanwhile, the declining demand could hamper construction of new petroleum stockpile facilities. If steady domestic production and imports increase regional stockpile to the critical level in the future, exports could be a promising option to control the stockpile level.

Meanwhile, natural gas supply in the U.S. was expected to exceed the domestic demand after 2022 in the AEO 2012 edition, but the situation has been revised to happen in 2017 in the 2014 edition. The U.S. government is currently aggressively authorizing natural gas liquefy and export projects that are scheduled to start in late 2010s.

The U.S. Energy Information Administration recently announced an early release version of "Annual Energy Outlook 2014". The annual report is usually announced in the second quarter every year and its early release is published in the end of prior year.

The most remarkable change from the previous year's edition is significant upward revision of petroleum production. Although natural gas output is upward revised year by year, the change of petroleum production from the 2013 edition in this time is much noteworthy.

Meanwhile, forecasts for the demand of petroleum had been already drastically changed in the 2013 edition from the previous steady upward tendency to the gradual down trend. The down trend is amended further down in the latest edition. On the other hand, natural gas demand is consecutively upward revised every year.

The long term outlook might have be set based on the government's policy. The change of AEO 2013 edition suggests that the U.S. government has changed the country's main energy resource from petroleum to natural gas in 2012. The change in the 2014 edition seems to promote the cancellation of crude oil export ban as well.

Petroleum demand in the U.S. is seen to shrink long-term, while domestic crude oil production is predicted to raised. However, imports are likely to continue since the domestic supply is not able to cover the entire demand. Meanwhile, the declining demand could hamper construction of new petroleum stockpile facilities. If steady domestic production and imports increase regional stockpile to the critical level in the future, exports could be a promising option to control the stockpile level.

Meanwhile, natural gas supply in the U.S. was expected to exceed the domestic demand after 2022 in the AEO 2012 edition, but the situation has been revised to happen in 2017 in the 2014 edition. The U.S. government is currently aggressively authorizing natural gas liquefy and export projects that are scheduled to start in late 2010s.

12.15.2013

Nuclear power is losing importance in Japan

A Japanese government panel recently advised to the central government to keep nuclear power as the nation's important and fundamental energy source. The government and utility firms could be actively to resume nuclear units. Currently all the nuclear units in Japan are shut.

However, since restarting requires further discussion and procedures, this winter will be the first time high electricity demand season without any nuclear power supply after the severe earthquake in 2011.

Especially, Kansai Electric Power Company will have the first experience to spend high demand season without nuclear units. Other electric companies have already survived previous winters and summers.

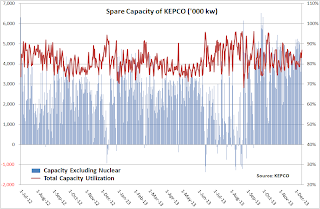

KEPCO forecasts that it could maintain more than 3% of spare generation capacity throughout this winter. But the daily maximum electricity demand in the company's service area had often exceeded its supply capacity excluding nuclear units in the previous few demand seasons. Therefore, the company will have to request to clients more reduction of electricity use.

Monthly electricity consumption in Japan has a tendency to decrease on year after the 2011 earthquake. Although the limit to the electricity supply has been expected to weigh on the country's economic growth, Japan's economic indicators have actually shown steady increase despite the lower electricity consumption.

Nuclear units are still necessary in order to maintain the nuclear technology development and keep an option of energy sources. However, its importance in Japan seems to have declined from the previous position.

On the other hand, Japanese power companies have increased use of liquefied natural gas for thermal power to make up for the shortage of nuclear power supply. Their monthly LNG consumption has risen to 4-5 million tonnes from the pre-earthquake level of 3-4 million tonnes. Beside the power firms' use, increasing fresh demands like co-generation have lifted Japan's monthly LNG imports by more than 1.5 million tonnes after the quake.

Meanwhile, North America is predicted to have about 20 million tonnes per month of LNG exporting capacity by the early 2020s due to the shale revolution. Many natural gas liquefy and export projects in the United States are being granted approvals.

Japan is expected to be a giant customer for the massive increase of LNG supply capacity. The U.S. energy industry might not hope that the Japanese natural gas demand will be hampered by nuclear power.

However, since restarting requires further discussion and procedures, this winter will be the first time high electricity demand season without any nuclear power supply after the severe earthquake in 2011.

Especially, Kansai Electric Power Company will have the first experience to spend high demand season without nuclear units. Other electric companies have already survived previous winters and summers.

KEPCO forecasts that it could maintain more than 3% of spare generation capacity throughout this winter. But the daily maximum electricity demand in the company's service area had often exceeded its supply capacity excluding nuclear units in the previous few demand seasons. Therefore, the company will have to request to clients more reduction of electricity use.

Monthly electricity consumption in Japan has a tendency to decrease on year after the 2011 earthquake. Although the limit to the electricity supply has been expected to weigh on the country's economic growth, Japan's economic indicators have actually shown steady increase despite the lower electricity consumption.

Nuclear units are still necessary in order to maintain the nuclear technology development and keep an option of energy sources. However, its importance in Japan seems to have declined from the previous position.

On the other hand, Japanese power companies have increased use of liquefied natural gas for thermal power to make up for the shortage of nuclear power supply. Their monthly LNG consumption has risen to 4-5 million tonnes from the pre-earthquake level of 3-4 million tonnes. Beside the power firms' use, increasing fresh demands like co-generation have lifted Japan's monthly LNG imports by more than 1.5 million tonnes after the quake.

Meanwhile, North America is predicted to have about 20 million tonnes per month of LNG exporting capacity by the early 2020s due to the shale revolution. Many natural gas liquefy and export projects in the United States are being granted approvals.

Japan is expected to be a giant customer for the massive increase of LNG supply capacity. The U.S. energy industry might not hope that the Japanese natural gas demand will be hampered by nuclear power.

12.09.2013

Chinese crude oil imports have exceeded demand

China imported 23.56 million tonnes or 5.75 million barrels per day of crude oil in November, according to the General Administration of Customs. It was 15.4% higher from a month ago and increased by 0.8% from a year earlier.

Although the country's crude oil imports dropped by 13.8% on year in October, rebounded in the following month. The average imports during three months since September rose 3.7% on year at 5.54 million bpd.

Accumulated crude oil imports in the first 11 months of 2013 was 255.2 million tonnes or 5.6 million bpd, up 3.2% from the same period a year ago.

Crude oil imports by China in this year have increased from the previous year's level despite the country had bought more than its actual demand of crude oil in 2012 in order to fill the newly built strategic petroleum reserve facilities. Current imports seem to exceed the nation's petroleum consumption.

The accumulated domestic crude oil production in China during the first 10 months in 2013 was 173 million tonnes. The total crude oil supply combined with net imports in the period was 426.7 million tonnes, 2.8% higher from a year ago.

Meanwhile, the total crude oil processing volume in January-October rose 4.1% on year to 396.9 million tonnes. Despite the growth of processing was higher than that of supply, volume of supply exceeded processing by nearly 3 million tonnes. The excess seemed to increase commercial crude oil stockpile in China throughout the period.

Commercial crude oil stockpile in China was estimated to have risen by around 1.4 million tonnes in 2010 and 2011. It was seen to have increased by only 0.4 million tonnes in 2012. Therefore, about 3 million tonnes during 10 months are quite higher.

Moreover, crude oil imports in November rebounded. Commercial crude oil stockpiles in China could increase further if the processing volume was not significantly higher in the month.

Energy resources are usually secured based on long-term forecasts. China has increased procurements of petroleum to meet a prediction of its future steady economic growth. However, the volume of procurements seems to begin exceeding the actual demand in the country.

Although the country's crude oil imports dropped by 13.8% on year in October, rebounded in the following month. The average imports during three months since September rose 3.7% on year at 5.54 million bpd.

Accumulated crude oil imports in the first 11 months of 2013 was 255.2 million tonnes or 5.6 million bpd, up 3.2% from the same period a year ago.

Crude oil imports by China in this year have increased from the previous year's level despite the country had bought more than its actual demand of crude oil in 2012 in order to fill the newly built strategic petroleum reserve facilities. Current imports seem to exceed the nation's petroleum consumption.

The accumulated domestic crude oil production in China during the first 10 months in 2013 was 173 million tonnes. The total crude oil supply combined with net imports in the period was 426.7 million tonnes, 2.8% higher from a year ago.

Meanwhile, the total crude oil processing volume in January-October rose 4.1% on year to 396.9 million tonnes. Despite the growth of processing was higher than that of supply, volume of supply exceeded processing by nearly 3 million tonnes. The excess seemed to increase commercial crude oil stockpile in China throughout the period.

Commercial crude oil stockpile in China was estimated to have risen by around 1.4 million tonnes in 2010 and 2011. It was seen to have increased by only 0.4 million tonnes in 2012. Therefore, about 3 million tonnes during 10 months are quite higher.

Moreover, crude oil imports in November rebounded. Commercial crude oil stockpiles in China could increase further if the processing volume was not significantly higher in the month.

Energy resources are usually secured based on long-term forecasts. China has increased procurements of petroleum to meet a prediction of its future steady economic growth. However, the volume of procurements seems to begin exceeding the actual demand in the country.

12.01.2013

Does China have unexpectedly many oil stockpile?

Number of days of supply of national petroleum stocks in China are said less than a month. It is far smaller than the United States or Japan. Is it true?

Chinese government has planned to increase its strategic petroleum reserve from the nearly zero level in early 2000s to 500 million barrels in 2020. However, China seems to have completed stockpiling only about 140 million barrels at moment.

Since average domestic petroleum consumption in the country was about 9.7 million barrels per day in 2012, the current strategic petroleum stocks are equivalent to 15 days of supply.

Member nations of the Organisation for Economic Cooperation and Development like the U.S. and Japan are required to secure more than 90 days of previous year's daily net imports of petroleum inventories. Calculation of days of supply is based on the net imports rather than consumption.

China is producing more than 4 million bpd of crude oil. The country's existing strategic petroleum stocks level can supply 25 days of net imports.

The strategic petroleum reserve of the U.S. only supply 37 days of consumption, and the Japanese national petroleum stocks can not supply more than 85 days of consumption. In Japan, private companies also have mandatory petroleum stockpile. The total of mandatory stockpile by the government and private sector could supply 153 days. Moreover, the total number of stockpiles including commercial inventories in Japan would reach supply of 200 days.

The SPR plus commercial petroleum stockpiles in the U.S. can supply 96 days of consumption and 230 days of net imports.

China also has commercial petroleum stockpiles in the private sector, but the actual numbers are not disclosed. Commercial petroleum inventories in October are estimated at about 310 million barrels based on calculation using various data. The stockpile level could supply 30 days of the country's consumption and provide 55 days of net imports.

Therefore, the total number of the national stockpile and commercial inventories in China reaches 80 days of net imports. The number is still much smaller than the U.S. or Japan, but seems not to be so unsafely.

However, about 90% of crude oil imports into China are currently carried by tankers. Land transportation from Russia or Kazakhstan are very limited. So China's petroleum import is likely to decline significantly in case of tensions in the adjacent waters.

China was originally planned to complete 300 million barrels of strategic petroleum stockpile by the end of 2013. But the schedule has delayed in step with the slowing down of the growth of the petroleum demand in the nation.

Currently, total 160 million barrels of national stockpile facilities are planned installing by the end of 2015, then another total 200 million barrels facilities will be built. However, further delay and changes might be seen.

Chinese government has planned to increase its strategic petroleum reserve from the nearly zero level in early 2000s to 500 million barrels in 2020. However, China seems to have completed stockpiling only about 140 million barrels at moment.

Since average domestic petroleum consumption in the country was about 9.7 million barrels per day in 2012, the current strategic petroleum stocks are equivalent to 15 days of supply.

Member nations of the Organisation for Economic Cooperation and Development like the U.S. and Japan are required to secure more than 90 days of previous year's daily net imports of petroleum inventories. Calculation of days of supply is based on the net imports rather than consumption.

China is producing more than 4 million bpd of crude oil. The country's existing strategic petroleum stocks level can supply 25 days of net imports.

The strategic petroleum reserve of the U.S. only supply 37 days of consumption, and the Japanese national petroleum stocks can not supply more than 85 days of consumption. In Japan, private companies also have mandatory petroleum stockpile. The total of mandatory stockpile by the government and private sector could supply 153 days. Moreover, the total number of stockpiles including commercial inventories in Japan would reach supply of 200 days.

The SPR plus commercial petroleum stockpiles in the U.S. can supply 96 days of consumption and 230 days of net imports.

China also has commercial petroleum stockpiles in the private sector, but the actual numbers are not disclosed. Commercial petroleum inventories in October are estimated at about 310 million barrels based on calculation using various data. The stockpile level could supply 30 days of the country's consumption and provide 55 days of net imports.

Therefore, the total number of the national stockpile and commercial inventories in China reaches 80 days of net imports. The number is still much smaller than the U.S. or Japan, but seems not to be so unsafely.

However, about 90% of crude oil imports into China are currently carried by tankers. Land transportation from Russia or Kazakhstan are very limited. So China's petroleum import is likely to decline significantly in case of tensions in the adjacent waters.

China was originally planned to complete 300 million barrels of strategic petroleum stockpile by the end of 2013. But the schedule has delayed in step with the slowing down of the growth of the petroleum demand in the nation.

Currently, total 160 million barrels of national stockpile facilities are planned installing by the end of 2015, then another total 200 million barrels facilities will be built. However, further delay and changes might be seen.

11.24.2013

US LNG exports become zero

Liquefied natural gas exports by the United States have declined to nearly zero. The U.S. has been a net LNG importer, while the nation is re-exporting exceeded LNG cargoes. But the change in the LNG trade structure has become remarkably.

LNG imports had increased in the U.S. in line with the rising natural gas consumption during the first half of 2000s. However, surging domestic gas production due to the shale revolution has oppressed LNG imports after 2010.

Since LNG prices are two-three times higher than pipeline supplied natural gas in the U.S., demand for LNG is shrinking. Average monthly LNG imports was 35.9 billion cubic feet in 2010 but slipped to 14.6 bcf in 2012. The average import figures have declined to 8.6 bcf in the first eight months in 2013.

Monthly volume of re-export LNG has also decreased from 5.4 bcf in 2010 to 2.4 bcf in 2012. The average in the first eight months in 2013 was only 15 million cf.

The change in the U.S. LNG trade structure seems to be the final phase toward the really net exporting country.

The U.S. government is aggressively giving approval of LNG exports to countries that have not signed on the Free Trade Agreement. Five LNG export projects have been granted approval. Four of the five projects were approved after May this year. Total supply capacity of the five projects is 7.8 bcf per day, or 58 million metric tonnes per year.

Sabine Pass project in Louisiana that was the first approved in 2011 is scheduled to start shipping of 2.2 bcf/d LNG in late 2015. Four other approved projects are also expected to start operations in 2017 or later.

Further 29 projects are under review by the Department of Energy. Total supply capacity of 34 projects are estimated at 34.1 bcf/d or 2,560 million tonnes per year. The total volume of globally traded LNG during 2012 was 31.7 bcf/d. The U.S. will have more supply capacity than it in early 2020s.

LNG imports had increased in the U.S. in line with the rising natural gas consumption during the first half of 2000s. However, surging domestic gas production due to the shale revolution has oppressed LNG imports after 2010.

Since LNG prices are two-three times higher than pipeline supplied natural gas in the U.S., demand for LNG is shrinking. Average monthly LNG imports was 35.9 billion cubic feet in 2010 but slipped to 14.6 bcf in 2012. The average import figures have declined to 8.6 bcf in the first eight months in 2013.

Monthly volume of re-export LNG has also decreased from 5.4 bcf in 2010 to 2.4 bcf in 2012. The average in the first eight months in 2013 was only 15 million cf.

The change in the U.S. LNG trade structure seems to be the final phase toward the really net exporting country.

The U.S. government is aggressively giving approval of LNG exports to countries that have not signed on the Free Trade Agreement. Five LNG export projects have been granted approval. Four of the five projects were approved after May this year. Total supply capacity of the five projects is 7.8 bcf per day, or 58 million metric tonnes per year.

Sabine Pass project in Louisiana that was the first approved in 2011 is scheduled to start shipping of 2.2 bcf/d LNG in late 2015. Four other approved projects are also expected to start operations in 2017 or later.

Further 29 projects are under review by the Department of Energy. Total supply capacity of 34 projects are estimated at 34.1 bcf/d or 2,560 million tonnes per year. The total volume of globally traded LNG during 2012 was 31.7 bcf/d. The U.S. will have more supply capacity than it in early 2020s.

11.17.2013

Oil demand forecast for China is declining

China has been the world's largest fossil fuel importer, since the Unites States is reducing energy imports following the shale revolution. China is recognized as the biggest engine of the growth in global petroleum consumption over the past several years. However, long term outlooks against the nation's oil demand are downgrading. It might suggest a change of the situation.

The latest outlooks of the global petroleum demand until 2025 was downgraded from the previous forecast in the World Oil Outlooks issued by the Organization of the Petroleum Exporting Countries. Meanwhile, forecasts against 2030 and later were upgraded.

Basically, oil demand in advanced nations were downward revised throughout the entire period, while demand in developing countries were upward revised. But Chinese demand was downgraded broadly unlike with other developing nations.

On the other hand, forecasts against growth of Chinese petroleum demand during the two decades until 2035 was wider than the previous year's prediction. It shows that the downward revision against the relatively clear forecasts of near future was deeper than the ambiguous prediction of far future.

In the long term, a core of the growth of oil demand is likely to shift from China to India and Southeast Asia etc.

The latest outlooks of the global petroleum demand until 2025 was downgraded from the previous forecast in the World Oil Outlooks issued by the Organization of the Petroleum Exporting Countries. Meanwhile, forecasts against 2030 and later were upgraded.

Basically, oil demand in advanced nations were downward revised throughout the entire period, while demand in developing countries were upward revised. But Chinese demand was downgraded broadly unlike with other developing nations.

On the other hand, forecasts against growth of Chinese petroleum demand during the two decades until 2035 was wider than the previous year's prediction. It shows that the downward revision against the relatively clear forecasts of near future was deeper than the ambiguous prediction of far future.

In the long term, a core of the growth of oil demand is likely to shift from China to India and Southeast Asia etc.

11.10.2013

Chinese crude oil demand rises towards year-end

Chinese refineries processed 9.71 million barrels per day of crude oil in October, according to the data released by the National Bureau of Statistics. It was 3.1% higher than a year earlier and 2.9% increased from a month ago. Although crude oil processing in China slipped from a year ago level in September, it rebounded to the highest level since March.

Meanwhile, China's crude oil imports in October fell 13.8% on year to 4.82 million bpd, according to the customs data. Since net crude oil imports in the month was 4.80 million bpd, the gap between the amount of processing was 4.91 million bpd. The shortage of supply was filled up by domestic production and the supply from inventories. Domestic crude oil production in China was averaged at 4.16 million bpd during the first nine months of 2013, meanwhile, crude oil stock in the country had increased by 11% during August and September.

The Chinese government announced that the country's industry production index rose 10.3 on year in October, it was the third consecutive double digits of year-on-year increase. Electricity generation in the nation rose 8.4% on year, automobile production surged by 25.5% from a year ago and ethylene output rose 16.9% on year. Those figures suggest a steady petroleum demand in China.

Petroleum inventories in China have a tendency that the crude oil stock hits the peak during the third quarter and the petroleum products stock sinks to the annual bottom in the same period. To the contrary, the inventory of crude oil falls to the bottom in the first quarter and the products stock rises to the annual highest level in the same period.

If the similar circulation will be repeated in the near future, crude oil processing in China could increase towards Q1 of 2014, and inventories of petroleum products are likely to rise. However, the petroleum products stock level in Q3 of this year was 6.1% higher than a year ago, it was a much larger increase than the crude oil stock level that was only 2.4% higher from the last year. A slower than expected consumption of petroleum products during the first nine months of this year might be caused such situation.

Chinese refineries increased their crude oil processing to above the 10 million bpd level during November 2012 and February 2013. Chinese industries seemed to decorate the strong economic growth at the beginning of the new Xi Jinping's administration. If Chinese refineries try to increase their crude oil processing at higher than the previous year's level in the coming several months, the already high petroleum product stock might surge to the critical level. Chinese oil companies could suffer the significant write-down if crude oil prices fall further.

Meanwhile, China's crude oil imports in October fell 13.8% on year to 4.82 million bpd, according to the customs data. Since net crude oil imports in the month was 4.80 million bpd, the gap between the amount of processing was 4.91 million bpd. The shortage of supply was filled up by domestic production and the supply from inventories. Domestic crude oil production in China was averaged at 4.16 million bpd during the first nine months of 2013, meanwhile, crude oil stock in the country had increased by 11% during August and September.

The Chinese government announced that the country's industry production index rose 10.3 on year in October, it was the third consecutive double digits of year-on-year increase. Electricity generation in the nation rose 8.4% on year, automobile production surged by 25.5% from a year ago and ethylene output rose 16.9% on year. Those figures suggest a steady petroleum demand in China.

Petroleum inventories in China have a tendency that the crude oil stock hits the peak during the third quarter and the petroleum products stock sinks to the annual bottom in the same period. To the contrary, the inventory of crude oil falls to the bottom in the first quarter and the products stock rises to the annual highest level in the same period.

If the similar circulation will be repeated in the near future, crude oil processing in China could increase towards Q1 of 2014, and inventories of petroleum products are likely to rise. However, the petroleum products stock level in Q3 of this year was 6.1% higher than a year ago, it was a much larger increase than the crude oil stock level that was only 2.4% higher from the last year. A slower than expected consumption of petroleum products during the first nine months of this year might be caused such situation.

Chinese refineries increased their crude oil processing to above the 10 million bpd level during November 2012 and February 2013. Chinese industries seemed to decorate the strong economic growth at the beginning of the new Xi Jinping's administration. If Chinese refineries try to increase their crude oil processing at higher than the previous year's level in the coming several months, the already high petroleum product stock might surge to the critical level. Chinese oil companies could suffer the significant write-down if crude oil prices fall further.

11.03.2013

Supply disruptions do not support crude oil market

Recently Reuters reported its survey that 12 members of the Organization of Petroleum Exporting Countries produced 29.9 million barrels per day of crude oil in October. It was the lowest output since October 2011. Beside this survey, other estimates by different media also have showed low OPEC productions.

A supply disruption from Libya due to labour disputes and a slower than expected recovery in Iraq that reduced supply in September due to repairs at its shipment facilities were seen as the main reasons of the low OPEC production.

The following table shows the latest forecasts of the world demand and supply of petroleum issued by the International Energy Agency, OPEC and the U.S. Energy Information Administration.

Since IEA and OPEC don't provide forecasts for OPEC crude oil production figures, differences between the global demand and the supply excluding OPEC crude oil are seen as the necessary volume of OPEC crude oil.

Necessary volumes of OPEC crude oil will remain below the 30 million bpd level between the fourth quarter of 2013 and the end of 2014, according to the IEA's prediction. Therefore, even the lowest estimation of OPEC production in October by media exceeds the necessary volume. The global petroleum market is slightly oversupply.

Meanwhile, OPEC predicts that its members' necessary crude oil output in the 4Q of 2013 at 30.49 million bpd. If the actual production in October stayed at about 30 million bpd, the global supply is in a little bit shortage.

EIA only provides forecasts for future OPEC crude oil production, but the figures seem to be too small compared to actual output in the last few quarters. If the actual output in October was at about 30 million bpd, the global petroleum supply and demand could be balanced rather than a shortage of 630,000 bpd as EIA expected.

Despite OPEC and EIA expect tight supply and demand situation in the world petroleum market, recent crude oil prices have been weaker. Although crude oil output in Libya has decreased by more than a million bpd from the production level through the first half of this year, it does not support the market well.

Crude oil supply disruption from Libya triggered the surge in the crude oil market in 2011. However, a balance of petroleum supply and demand in the North America was about 7 million bpd at that time. The region had imported that much petroleum from the overseas. But the shortage have been shrinked to below 4 million bpd due to the shale revolution. Petroleum imports in the North America region are expected to decrease below 2.5 million bpd in late 2014.

More than 3 million bpd of crude oil from the Middle East and Africa has lost the North American market and spilled out towards the other markets. Thus the necessary of OPEC crude oil has been decreasing. Supply disruptions in Libya and Nigeria no longer are strong supportive factors for the crude oil market.

A supply disruption from Libya due to labour disputes and a slower than expected recovery in Iraq that reduced supply in September due to repairs at its shipment facilities were seen as the main reasons of the low OPEC production.

The following table shows the latest forecasts of the world demand and supply of petroleum issued by the International Energy Agency, OPEC and the U.S. Energy Information Administration.

Since IEA and OPEC don't provide forecasts for OPEC crude oil production figures, differences between the global demand and the supply excluding OPEC crude oil are seen as the necessary volume of OPEC crude oil.

Necessary volumes of OPEC crude oil will remain below the 30 million bpd level between the fourth quarter of 2013 and the end of 2014, according to the IEA's prediction. Therefore, even the lowest estimation of OPEC production in October by media exceeds the necessary volume. The global petroleum market is slightly oversupply.

Meanwhile, OPEC predicts that its members' necessary crude oil output in the 4Q of 2013 at 30.49 million bpd. If the actual production in October stayed at about 30 million bpd, the global supply is in a little bit shortage.

EIA only provides forecasts for future OPEC crude oil production, but the figures seem to be too small compared to actual output in the last few quarters. If the actual output in October was at about 30 million bpd, the global petroleum supply and demand could be balanced rather than a shortage of 630,000 bpd as EIA expected.

Despite OPEC and EIA expect tight supply and demand situation in the world petroleum market, recent crude oil prices have been weaker. Although crude oil output in Libya has decreased by more than a million bpd from the production level through the first half of this year, it does not support the market well.

Crude oil supply disruption from Libya triggered the surge in the crude oil market in 2011. However, a balance of petroleum supply and demand in the North America was about 7 million bpd at that time. The region had imported that much petroleum from the overseas. But the shortage have been shrinked to below 4 million bpd due to the shale revolution. Petroleum imports in the North America region are expected to decrease below 2.5 million bpd in late 2014.

More than 3 million bpd of crude oil from the Middle East and Africa has lost the North American market and spilled out towards the other markets. Thus the necessary of OPEC crude oil has been decreasing. Supply disruptions in Libya and Nigeria no longer are strong supportive factors for the crude oil market.

10.27.2013

Hybrid cars are reducing Japanese oil demand

Crude oil processing by Japanese refineries in the week ended on 19 October fell 6.1% on year to 2.93 million barrels per day, according to the Petroleum Association of Japan. It was the second consecutive year-on-year decrease following the previous week.

Since Japanese refineries have planned to cut crude oil processing in the fourth quarter of this year, recent lower refinery runs are not surprising. However, although Japanese refiners have set lower processing plans since the beginning of this year, their actual output was higher than previous year levels between June and September. Recent figures seem to show a slowing of the demand recovery.

One of major reasons why Japanese refineries are not aggressive to process crude oil is the sluggish domestic gasoline demand. Gasoline accounts for nearly 30% of the total demand of petroleum products in Japan. Refiners become to be not able to ignore an accelerating diffusion of fuel-efficient vehicles like hybrid cars.

Hybrid vehicles accounted for only 0.5% of the total registered cars in Japan as of March 2007, but its market share rose to 4.2% as of March 2013. On the other hand, about 15% of monthly manufactured passenger-cars are hybrid vehicles currently.

The total numbers of manufacturing cars and registration in Japan are decreasing, while the supply of hybrid vehicles is steady. Therefore, gasoline demand in the country is under the downward trend basically. Even if monthly gasoline demand rises on year, it is likely to be a rebound from slump in the previous year.

A slowdown of fuel oil consumption also discourages Japanese refineries. Fuel oil accounts for about 15% of the total petroleum products demand in the nation. Monthly demand of the product has recorded more than 20% of year-on-year decreases since March this year.

The nationwide power saving has suppressed the electricity demand in Japan after the severe earthquake in March 2011. Although entire nuclear power plants in the nation are shut, any significant shortage of electricity supply has not been reported. An urgent fuel oil demand for power generation due to the nuclear plants shutdown is going to end in line with expanding gas turbine and coal-burning power generation facilities.

Since Japanese refineries have planned to cut crude oil processing in the fourth quarter of this year, recent lower refinery runs are not surprising. However, although Japanese refiners have set lower processing plans since the beginning of this year, their actual output was higher than previous year levels between June and September. Recent figures seem to show a slowing of the demand recovery.

One of major reasons why Japanese refineries are not aggressive to process crude oil is the sluggish domestic gasoline demand. Gasoline accounts for nearly 30% of the total demand of petroleum products in Japan. Refiners become to be not able to ignore an accelerating diffusion of fuel-efficient vehicles like hybrid cars.

Hybrid vehicles accounted for only 0.5% of the total registered cars in Japan as of March 2007, but its market share rose to 4.2% as of March 2013. On the other hand, about 15% of monthly manufactured passenger-cars are hybrid vehicles currently.

The total numbers of manufacturing cars and registration in Japan are decreasing, while the supply of hybrid vehicles is steady. Therefore, gasoline demand in the country is under the downward trend basically. Even if monthly gasoline demand rises on year, it is likely to be a rebound from slump in the previous year.

A slowdown of fuel oil consumption also discourages Japanese refineries. Fuel oil accounts for about 15% of the total petroleum products demand in the nation. Monthly demand of the product has recorded more than 20% of year-on-year decreases since March this year.

The nationwide power saving has suppressed the electricity demand in Japan after the severe earthquake in March 2011. Although entire nuclear power plants in the nation are shut, any significant shortage of electricity supply has not been reported. An urgent fuel oil demand for power generation due to the nuclear plants shutdown is going to end in line with expanding gas turbine and coal-burning power generation facilities.

10.20.2013

Energy demand suggests China's economy slow down

Chinese Gross Domestic Product during the third quarter recorded the highest growth since Q4 2012. Although the crude oil market is supported by the optimistic forecasts against the petroleum demand in China, a recent slump in energy demand in the nation suggests the economy slow down in the near term.

The industrial production index in China rose 10.2% from a year ago in September, according to the National Bureau of Statistics. It was the second consecutive double digits growth following August. Meanwhile, the country's power generation and petroleum demand were slowing down in the same month. Especially, crude oil processing posted a year-on-year decrease for the first time since June 2012.

Energy demand in China had continued to increase during the second half of 2012 when the nation's economy showed a certain recovery. However, energy consumptions are stalling already in this year. The change could affect the economic growth in the near future. If the energy demand can not recover, China is not likely to record the strong economic growth like last year.

The following chart shows supply and demand of crude oil in China. Since the government has not released the September's domestic crude oil production yet, the chart estimated it as the same level as August.

The total crude oil supply of net imports and domestic production have exceeded the 10 million barrels per day level recently. On the other hand, crude oil processing had exceeded the key level between November 2012 and February 2013, but has been sluggish after that.

Automobile production in China rose 15.3% from a year ago in the first nine months in this year, compared to the 6.3% on year increase during 2012. The recent sluggish total demand of petroleum despite the stronger gasoline consumption suggests a significantly weak diesel demand from the transportation sector and a slump in fuel oil use by the manufacturing sector.

The industrial production index in China rose 10.2% from a year ago in September, according to the National Bureau of Statistics. It was the second consecutive double digits growth following August. Meanwhile, the country's power generation and petroleum demand were slowing down in the same month. Especially, crude oil processing posted a year-on-year decrease for the first time since June 2012.

Energy demand in China had continued to increase during the second half of 2012 when the nation's economy showed a certain recovery. However, energy consumptions are stalling already in this year. The change could affect the economic growth in the near future. If the energy demand can not recover, China is not likely to record the strong economic growth like last year.

The following chart shows supply and demand of crude oil in China. Since the government has not released the September's domestic crude oil production yet, the chart estimated it as the same level as August.

The total crude oil supply of net imports and domestic production have exceeded the 10 million barrels per day level recently. On the other hand, crude oil processing had exceeded the key level between November 2012 and February 2013, but has been sluggish after that.

Automobile production in China rose 15.3% from a year ago in the first nine months in this year, compared to the 6.3% on year increase during 2012. The recent sluggish total demand of petroleum despite the stronger gasoline consumption suggests a significantly weak diesel demand from the transportation sector and a slump in fuel oil use by the manufacturing sector.

10.13.2013

Why Chinese crude oil imports are surging?

China imported 25.68 million tonnes or 6.27 million barrels per day of crude oil in September, according to the Customs General Administration. It was 27.9% higher than a year ago and renewed the historical record.

The country's monthly crude oil imports were sometimes below the previous year level during the first half of this year, since China stored crude oil into newly built strategic reserve facilities in the first several months in 2012. But the monthly import figures have scored double digits growth in the last three months.

Meanwhile, commercial crude oil stocks as of the end of August were 9.7% higher from a month ago, according to the Xinhua News. The record high import level in September could have caused a further significant increase of Chinese crude oil stocks.

Although stocks of petroleum products in China as of end-August decreased 5.3% from a month ago, it was still 8.5% higher from a year before. So it seemed that Chinese refineries were not strongly required to build product inventories so much during September ahead of long holidays in early October.

However, China's industrial production index rose 10.4% on year in August, it was the first double digits growth since last December. Refineries might have started securing crude oil inventories on expectations of further steady petroleum demand from the industrial sector.

Chinese refineries usually set the annual highest crude oil processing during the 4th quarter and the following year's 1st quarter. The country's crude oil processing exceed 10 million bpd between November 2012 and February 2013, but it has recently been decreased to the 9 million bpd level first half. The higher crude oil imports could suggest beginning of another round of growth of crude oil processing towards the end of this year.

The country's monthly crude oil imports were sometimes below the previous year level during the first half of this year, since China stored crude oil into newly built strategic reserve facilities in the first several months in 2012. But the monthly import figures have scored double digits growth in the last three months.

Meanwhile, commercial crude oil stocks as of the end of August were 9.7% higher from a month ago, according to the Xinhua News. The record high import level in September could have caused a further significant increase of Chinese crude oil stocks.

Although stocks of petroleum products in China as of end-August decreased 5.3% from a month ago, it was still 8.5% higher from a year before. So it seemed that Chinese refineries were not strongly required to build product inventories so much during September ahead of long holidays in early October.

However, China's industrial production index rose 10.4% on year in August, it was the first double digits growth since last December. Refineries might have started securing crude oil inventories on expectations of further steady petroleum demand from the industrial sector.

Chinese refineries usually set the annual highest crude oil processing during the 4th quarter and the following year's 1st quarter. The country's crude oil processing exceed 10 million bpd between November 2012 and February 2013, but it has recently been decreased to the 9 million bpd level first half. The higher crude oil imports could suggest beginning of another round of growth of crude oil processing towards the end of this year.

10.06.2013

East Asia may compete with ASEAN for LNG purchase

Japanese liquefied natural gas imports previously had been deeply relied on Southeast Asia. The nation imported more than 70% of LNG from Southeast Asian countries like Indonesia in 1990s, but the dependency is decreasing. Increased spot purchase from the various areas reduces Southeast Asian share in Japanese LNG imports to about 30%. Japan's LNG imports have surged due to the nuclear plants shutdown following the severe earthquake in March 2011. Recently, monthly supply from the Southeast Asia region is sometimes below the imports from the Middle East.

LNG outputs in the Southeast Asia area are expected to increase by about 20% from the current level during the next couple of years due to installing new facilities, according to the International Energy Agency. After that, however, LNG supply in the area is likely to be capped, while the natural gas demand in the region is forecasted to grow steady. Therefore, net LNG exports from Southeast Asia are seen to be declining for the long term.

According to the plans on future LNG development in the area, 5 supply facilities are planned to be build, but the total number of LNG reception facilities that will be constructed are 10. Demand side is twice than the supply side.

The petroleum balance in Southeast Asia is currently net imports by 2 million barrels per day despite the region was the oil supplier previously. Indonesia withdrew from the Organization of Petroleum Exporting Countries in 2009. In the future, the region is expected to be a net consumer of the other energy resources as well.

Forecast on Southeast Asian energy demand by the IEA is based on the prediction about economic growth in the region. The average annual growth of gross domestic products during 1990 and 2011 in the region was 5.0%. It is expected to be 5.5% in 2010s and forecasted to be 4.1% between 2020 and 2035. If more than expected manufacturers move from China into Southeast Asia, the economic growth rate might be changed.

East Asian nations like Japan had relied on LNG supply to Southeast Asia, but the two regions may become to compete for LNG procurements from the North America or the Middle East.

9.29.2013

Power outages are eliminating in India

Electricity supply in India usually has not been enough. The largest power outage in the history occurred in July 2012 in northern and eastern part of the country.

However, the recent lower growth of economy seems to be changing the situation. A decreasing of the power supply shortage ratio is likely to eliminate even minor day-to-day power outages.

The electricity supply capacity in India has not caught up with the growing demand as with other developing nations. Its additional supply capacity only achieved about half of the target set by every five-year economic plan since 1990s. Thus electricity supply capacity was shortage against the peak demand by 12-17% through 2000s.

The shortage ratio has been declining after mid-2010. The decrease is accelerated in this year and the latest number in August was only 2.7%.

Indian economic growth rate was near 10% during the latter half of 2000s except for the Lehman Shock period. But it has been below 5% in the recent three consecutive quarters. Year-on-year growth of the Index of Industrial Production in the country has been almost stopped since Q4 of 2011. Slower industrial activities, of course causes the sluggish energy demand.

In this year, monthly electricity supply in India recorded twice a decrease on year. It did not occur even after the Lehman Shock.

On the other hand, the supply capacity expansion plan that had not been achieved enough previously is also changing during the 12th five-year plan started in April 2012. India installed 22 million kilowatt of new electricity generation capacities in the first year of the current five-year plan. The total capacity of 76 million kw is scheduled to be added during this plan, therefore, the plan seems to be running at a faster speed considerably at moment.

Even if the growth pace of the power generation capacity is slowing down in the near future, further slower growth of electricity demand might prevent the severe blackout.

However, the recent lower growth of economy seems to be changing the situation. A decreasing of the power supply shortage ratio is likely to eliminate even minor day-to-day power outages.

The electricity supply capacity in India has not caught up with the growing demand as with other developing nations. Its additional supply capacity only achieved about half of the target set by every five-year economic plan since 1990s. Thus electricity supply capacity was shortage against the peak demand by 12-17% through 2000s.

The shortage ratio has been declining after mid-2010. The decrease is accelerated in this year and the latest number in August was only 2.7%.

Indian economic growth rate was near 10% during the latter half of 2000s except for the Lehman Shock period. But it has been below 5% in the recent three consecutive quarters. Year-on-year growth of the Index of Industrial Production in the country has been almost stopped since Q4 of 2011. Slower industrial activities, of course causes the sluggish energy demand.

In this year, monthly electricity supply in India recorded twice a decrease on year. It did not occur even after the Lehman Shock.

On the other hand, the supply capacity expansion plan that had not been achieved enough previously is also changing during the 12th five-year plan started in April 2012. India installed 22 million kilowatt of new electricity generation capacities in the first year of the current five-year plan. The total capacity of 76 million kw is scheduled to be added during this plan, therefore, the plan seems to be running at a faster speed considerably at moment.

Even if the growth pace of the power generation capacity is slowing down in the near future, further slower growth of electricity demand might prevent the severe blackout.

9.22.2013

Overflow from US is changing global oil balance

Domestic crude oil production in the United States was 7.83 million barrels per day, while crude oil imports was 7.58 million bpd, according to the latest weekly report by the Energy Information Administration. Domestic output exceeded imports for the second time in this year after recording for the first time in May since early 1997.

Although crude oil imports exceeded domestic production significantly throughout 2000s, increasing unconventional oil production like shale oil has made narrowing the gap after mid-2011.

Monthly average production has not exceeded imports yet, but it also could be seen in the near future.

Since supply from Canada, that increases unconventional oil production as well, is steady, flows of crude oil from Latin America or Africa into U.S. are decreasing notably.

Crude oil supply in West African Nigeria except for exports to the U.S. has soared by 1 million bpd over the past several years.

Average domestic crude oil output in the U.S. was slightly above 5 million bpd in mid-2000s, however, it has risen to near 8 million bpd recently and is expected to reach 10 million bpd in a couple of years. On the other hand, petroleum demand in the north America has been capped. Therefore, imports of crude oil are more decreasing than change of production. Suppliers who had relied on the U.S. have to find alternative buyers.

Shrinking oil supply from Iran due to the international sanction has not affected significantly on the global oil market. Recent supply disruption in Libya has not given sufficient impact on the market like civil war in 2011. The reason of these situations seems to be the overflow from suppliers that lost U.S. market.

Since this tendency is seen to be accelerated in the future, temporary oil supply disruptions are unlikely to affect on the real market as ever.

Although crude oil imports exceeded domestic production significantly throughout 2000s, increasing unconventional oil production like shale oil has made narrowing the gap after mid-2011.

Monthly average production has not exceeded imports yet, but it also could be seen in the near future.

Since supply from Canada, that increases unconventional oil production as well, is steady, flows of crude oil from Latin America or Africa into U.S. are decreasing notably.

Crude oil supply in West African Nigeria except for exports to the U.S. has soared by 1 million bpd over the past several years.

Average domestic crude oil output in the U.S. was slightly above 5 million bpd in mid-2000s, however, it has risen to near 8 million bpd recently and is expected to reach 10 million bpd in a couple of years. On the other hand, petroleum demand in the north America has been capped. Therefore, imports of crude oil are more decreasing than change of production. Suppliers who had relied on the U.S. have to find alternative buyers.

Shrinking oil supply from Iran due to the international sanction has not affected significantly on the global oil market. Recent supply disruption in Libya has not given sufficient impact on the market like civil war in 2011. The reason of these situations seems to be the overflow from suppliers that lost U.S. market.

Since this tendency is seen to be accelerated in the future, temporary oil supply disruptions are unlikely to affect on the real market as ever.

9.15.2013

Concession structure in Chinese oil industry to collapse

One of twin Chinese petroleum giants China National Petroleum Corporation is facing serious difficulties since late August due to corruption allegation.

Four executives of the company including two of vice-presidents were dismissed, and received investigation on suspicion of serious breach of discipline. Then, investigation against Jiang Jieming, who was former chairman of CNPC until March this year, was also started in September. He had become a minister in charge of supervise state-run companies after leaving CNPC.

In the company, section manager or higher class have already been confiscated passports in order to prevent escaping to overseas. More employees are likely to be detained or will be called as witness.

Final target of the series of investigations is expected to be Zhou Yongkang who was former CNPC chairman and ex-senior leader of Chinese Communist Party. Dismissed CNPC executives were Zhou's entourages.

Zhou is known as the big boss of petroleum faction in the Chinese political world. But he could be the first arrested ex-Politburo Standing Committee member after the Cultural Revolution.

Chinese media recently reported that family members of Zhou's daughter in law have earned 800 million US dollars through suspicious equipment deals with CNPC. The deals seems to be part of activities to make secret funds of the faction.

The petroleum faction has influenced on Chinese politics in the background of plenty financial power. Business scales of CNPC and Sinopec are not inferior to international oil major ExxonMobil.

However, profit structure of these Chinese companies are not equal. Downstream concentrated Sinopec earns more sales revenue than upstream concentrated CNPC, but Sinopec's profit is about half of CNPC due to unprofitable refining sector.

Since petroleum products prices in China are rigidly limited by the government, refineries often suffer losses when products prices do not cover crude oil costs.

CNPC has enjoyed steady oil prices after 2000s, while its profit ratio looks lower than ExxonMobil. It seems not only due to unprofitable refining sector, but also because of manipulation to make secret funds.

If purge of executives to expand broadly, could CNPC be able to maintain its organization? Collapse of the concession structure also could stimulate competition over it.

Four executives of the company including two of vice-presidents were dismissed, and received investigation on suspicion of serious breach of discipline. Then, investigation against Jiang Jieming, who was former chairman of CNPC until March this year, was also started in September. He had become a minister in charge of supervise state-run companies after leaving CNPC.

In the company, section manager or higher class have already been confiscated passports in order to prevent escaping to overseas. More employees are likely to be detained or will be called as witness.

Final target of the series of investigations is expected to be Zhou Yongkang who was former CNPC chairman and ex-senior leader of Chinese Communist Party. Dismissed CNPC executives were Zhou's entourages.

Zhou is known as the big boss of petroleum faction in the Chinese political world. But he could be the first arrested ex-Politburo Standing Committee member after the Cultural Revolution.

Chinese media recently reported that family members of Zhou's daughter in law have earned 800 million US dollars through suspicious equipment deals with CNPC. The deals seems to be part of activities to make secret funds of the faction.

The petroleum faction has influenced on Chinese politics in the background of plenty financial power. Business scales of CNPC and Sinopec are not inferior to international oil major ExxonMobil.

However, profit structure of these Chinese companies are not equal. Downstream concentrated Sinopec earns more sales revenue than upstream concentrated CNPC, but Sinopec's profit is about half of CNPC due to unprofitable refining sector.

Since petroleum products prices in China are rigidly limited by the government, refineries often suffer losses when products prices do not cover crude oil costs.

CNPC has enjoyed steady oil prices after 2000s, while its profit ratio looks lower than ExxonMobil. It seems not only due to unprofitable refining sector, but also because of manipulation to make secret funds.

If purge of executives to expand broadly, could CNPC be able to maintain its organization? Collapse of the concession structure also could stimulate competition over it.

9.08.2013

Japan's electricity supply has been in the worst crisis during hot summer

Recently Japanese people are not seriously discussing electricity supply shortage, but the nation's power supply during this summer has been in the worst crisis since the severe earthquake in 2011.

Electricity supply capacity utilization by Tokyo Electric Power Company exceeded 90% seven times by the end of August this year, compared to only once during the summer season in 2012.

Electricity demand in the service area of western Japan's Kansai Electric Power Company exceeded its supply capacity excluding two running nuclear units 15 days during July-August. That was occurred only once during the summer in 2012. KEPCO's electricity supply exceeded the critical level of 95% utilization for the first time in June this year and repeated five times during July-August.

Extremely hot day, that is a day temperature exceeds 35 degrees Celcius, was recorded in Tokyo four times in 2011 and six times in 2012. But there were eleven times by the end of August in 2013, according to the Meteorological Agency. Extremely hot days in Osaka were nearly doubled to 23 times in 2013 from 12 times in 2012.

On the other hand, TEPCO's electricity supply often has been in crisis during autumn when many thermal power plants were shut for maintenance after the peak demand season. The company's capacity utilization once exceeded 95% in November 2012.

One of the KEPCO's two operating nuclear units has stopped since 2nd September for regular maintenance, and another unit is also scheduled to shut on 15th September by same reason. End of the maintenance period at the nuclear units is not decided yet.

Power demand in the KEPCO's service area exceeded its supply capacity excluding nuclear units eight times during last winter. If next winter is very cold, electricity supply could be in anxious.

Capital investment by Japanese companies rose from a year ago in April-June 2013 for the first time since Q3 in 2012, according to the Ministry of Finance. Electricity demand in Japan seems to increase even if many companies are still trying to reduce power consumption.

However, expected consumption tax hike may hamper growth of Japanese economy and eliminate electricity supply anxiety.

Electricity supply capacity utilization by Tokyo Electric Power Company exceeded 90% seven times by the end of August this year, compared to only once during the summer season in 2012.

Electricity demand in the service area of western Japan's Kansai Electric Power Company exceeded its supply capacity excluding two running nuclear units 15 days during July-August. That was occurred only once during the summer in 2012. KEPCO's electricity supply exceeded the critical level of 95% utilization for the first time in June this year and repeated five times during July-August.

Extremely hot day, that is a day temperature exceeds 35 degrees Celcius, was recorded in Tokyo four times in 2011 and six times in 2012. But there were eleven times by the end of August in 2013, according to the Meteorological Agency. Extremely hot days in Osaka were nearly doubled to 23 times in 2013 from 12 times in 2012.

On the other hand, TEPCO's electricity supply often has been in crisis during autumn when many thermal power plants were shut for maintenance after the peak demand season. The company's capacity utilization once exceeded 95% in November 2012.

One of the KEPCO's two operating nuclear units has stopped since 2nd September for regular maintenance, and another unit is also scheduled to shut on 15th September by same reason. End of the maintenance period at the nuclear units is not decided yet.

Power demand in the KEPCO's service area exceeded its supply capacity excluding nuclear units eight times during last winter. If next winter is very cold, electricity supply could be in anxious.

Capital investment by Japanese companies rose from a year ago in April-June 2013 for the first time since Q3 in 2012, according to the Ministry of Finance. Electricity demand in Japan seems to increase even if many companies are still trying to reduce power consumption.

However, expected consumption tax hike may hamper growth of Japanese economy and eliminate electricity supply anxiety.

9.01.2013

Libyan unrest causes global oil shortage again

Crude oil production in Libya has been declined to the critical low level close to civil war period. If other members of the Organization of Petroleum Exporting Countries do not increase supply enough, global balance of petroleum supply and demand could be significantly tight.

Labour dispute has been increasing in broad industries of Libya since June. In energy sector, the nation's crude oil output, that had been about 1.4 million barrels per day during first five months in this year, dipped to 1.2 million bpd in June and sunk further to 1.06 million bpd in July.

Average crude oil production in August is estimated at 500 thousand bpd level due to the spreading of strike in major ports. Brega is the only port currently continues shipment at moment, while other major ports have been closed since mid-August.

Moreover, armed group closed pipeline between western major oil fields and ports in late August. Current Libyan crude oil output is estimated at below 300,000 bpd due to the pipeline closure.

Libyan crude oil output once declined from 1.6 million bpd to nearly zero in the civil war period in 2011. NYMEX crude oil futures surged from about $90/bbl to above $110/bbl at that time.

Saudi Arabia and other OPEC members increased supply urgently in order to make up for the shortage. However, recovery of Libyan oil supply was faster than expected after the cease of the civil war in October. OPEC's total crude oil production in Q2 2012 exceeded the pre-war level by 1.5 million bpd. Crude oil futures dropped to below $80/bbl.

What about current situation? Global balance of petroleum supply and demand in Q3 2013 estimated by the U.S. Energy Information Administration or International Energy Agency and OPEC are as follows.

Necessary volume of OPEC crude oil is estimated at about 30-30.4 million bpd. Meanwhile, OPEC and IEA estimate actual OPEC members' total output in July at about 30.4 million bpd. Average production level in August is seen at 30.2 million level, according to surveys by media.

Since current Libyan production level is estimated to decrease by more than 300,000 bpd from the August average, total OPEC output could be below 30 million bpd. OPEC is not able to supply enough crude oil to the required volume if other members do not increase production.

On the other hand, Libya is anticipated to recover supply sooner after ending the strike, so other OPEC members aggressive supply may cause oversupply in the world crude oil market again.

Labour dispute has been increasing in broad industries of Libya since June. In energy sector, the nation's crude oil output, that had been about 1.4 million barrels per day during first five months in this year, dipped to 1.2 million bpd in June and sunk further to 1.06 million bpd in July.

Average crude oil production in August is estimated at 500 thousand bpd level due to the spreading of strike in major ports. Brega is the only port currently continues shipment at moment, while other major ports have been closed since mid-August.

Moreover, armed group closed pipeline between western major oil fields and ports in late August. Current Libyan crude oil output is estimated at below 300,000 bpd due to the pipeline closure.

Libyan crude oil output once declined from 1.6 million bpd to nearly zero in the civil war period in 2011. NYMEX crude oil futures surged from about $90/bbl to above $110/bbl at that time.

Saudi Arabia and other OPEC members increased supply urgently in order to make up for the shortage. However, recovery of Libyan oil supply was faster than expected after the cease of the civil war in October. OPEC's total crude oil production in Q2 2012 exceeded the pre-war level by 1.5 million bpd. Crude oil futures dropped to below $80/bbl.

What about current situation? Global balance of petroleum supply and demand in Q3 2013 estimated by the U.S. Energy Information Administration or International Energy Agency and OPEC are as follows.

Necessary volume of OPEC crude oil is estimated at about 30-30.4 million bpd. Meanwhile, OPEC and IEA estimate actual OPEC members' total output in July at about 30.4 million bpd. Average production level in August is seen at 30.2 million level, according to surveys by media.

Since current Libyan production level is estimated to decrease by more than 300,000 bpd from the August average, total OPEC output could be below 30 million bpd. OPEC is not able to supply enough crude oil to the required volume if other members do not increase production.

On the other hand, Libya is anticipated to recover supply sooner after ending the strike, so other OPEC members aggressive supply may cause oversupply in the world crude oil market again.

8.25.2013

China's petroleum fuel demand reaches record high

Petroleum fuel consumption in China was estimated to be the record high in July. Although crude oil processing in the country in July rose 7.1% on year to 1.39 million tonnes per day, crude oil processing figures have been decreasing after the previous record that was scored in December 2012. Meanwhile, shipment of petroleum fuel rose to the record high in July, since suppliers reduced inventories.

China's crude oil import in July was record high at 842,000 tonnes per day, while the country's end-July crude oil stocks fell 1.6% from a month ago. It is not sure whether the higher import was stored to strategic reserve without being processed in the month or not. However, supply of petroleum fuel such as gasoline and diesel seemed not to be enough in July, because petroleum fuel stocks as of end-July fell 5.0% from a month earlier. Especially, gasoline inventory slipped 7.2% on month.

Automobile manufacturing in China rose 15.1% on year in the first seven months in this year. It is quite higher growth compared to 6.3% on year during 2012. More cars require more fuel like gasoline and diesel. It's OK. Meanwhile, slower crude oil processing in China over the past several months despite the steady growth of petroleum fuel could suggest slump in demand for other industrial fuel or petrochemical materials.

China's crude oil import in July was record high at 842,000 tonnes per day, while the country's end-July crude oil stocks fell 1.6% from a month ago. It is not sure whether the higher import was stored to strategic reserve without being processed in the month or not. However, supply of petroleum fuel such as gasoline and diesel seemed not to be enough in July, because petroleum fuel stocks as of end-July fell 5.0% from a month earlier. Especially, gasoline inventory slipped 7.2% on month.

Automobile manufacturing in China rose 15.1% on year in the first seven months in this year. It is quite higher growth compared to 6.3% on year during 2012. More cars require more fuel like gasoline and diesel. It's OK. Meanwhile, slower crude oil processing in China over the past several months despite the steady growth of petroleum fuel could suggest slump in demand for other industrial fuel or petrochemical materials.

8.18.2013

Is first Chinese crude oil futures prepared well?

China has aimed to launch domestic crude oil futures market since early last year. Chinese government originally announced to start trading the crude oil futures by the end of 2012, then the launch was postponed to early 2013. The official plan has been changed again to the end of 2013. Further postpones might be seen.

Recently, news reported two private companies in Zhejian province in eastern China have been granted license to store each 7 million barrels of crude oil. It was the first case private companies were granted crude oil storage licenses.

China has about 200 million barrels of strategic petroleum reserves at national storage facilities and major state-owned companies. The amount could cover about 20 days of the nation's petroleum consumption. Meanwhile, Chinese private companies don't have crude oil storage at moment.

On the other hand, Chinese government is scheduled to allow private companies to import crude oil in 2014. Crude oil imports in the country has been permitted only to some major state-owned companies. China's total crude oil import in 2012 was 271 million tonnes or 5.42 million barrels per day. However, private companies could be allowed to import only 10 million tonnes in 2014.

If China launches crude oil futures without enough commercial stocks and free import, the market seems to become gambling place that does not have relationship with physical market. Futures market project under such situation seems to be a figment.

Some market participants are expecting that crude oil storage and import by private sector may satisfy requirement of healthy futures market. But they are still missing overwhelmingly compared to the total crude oil distribution in China. In the United States, commercial crude oil stocks are about 360 million barrels compared to the strategic reserve of 7 million barrels.

In the fast economic growing country, systems may be reformed more rapidly than expected after started changing. However, it is not sure that liberalization in the Chinese crude oil market will accelerate or not.

Recently, news reported two private companies in Zhejian province in eastern China have been granted license to store each 7 million barrels of crude oil. It was the first case private companies were granted crude oil storage licenses.

China has about 200 million barrels of strategic petroleum reserves at national storage facilities and major state-owned companies. The amount could cover about 20 days of the nation's petroleum consumption. Meanwhile, Chinese private companies don't have crude oil storage at moment.

On the other hand, Chinese government is scheduled to allow private companies to import crude oil in 2014. Crude oil imports in the country has been permitted only to some major state-owned companies. China's total crude oil import in 2012 was 271 million tonnes or 5.42 million barrels per day. However, private companies could be allowed to import only 10 million tonnes in 2014.

If China launches crude oil futures without enough commercial stocks and free import, the market seems to become gambling place that does not have relationship with physical market. Futures market project under such situation seems to be a figment.

Some market participants are expecting that crude oil storage and import by private sector may satisfy requirement of healthy futures market. But they are still missing overwhelmingly compared to the total crude oil distribution in China. In the United States, commercial crude oil stocks are about 360 million barrels compared to the strategic reserve of 7 million barrels.

In the fast economic growing country, systems may be reformed more rapidly than expected after started changing. However, it is not sure that liberalization in the Chinese crude oil market will accelerate or not.

8.11.2013

Japan's oil demand recovers regardless of the thermal power

Petroleum demand is recovering in Japan. Although many people imagine that it is due to consumption for thermal power triggered by heat wave, recent growth of petroleum demand in the nation is actually not related to electricity. Petroleum consumption for thermal power is rather decreasing in Japan.