Gasoline stocks in the United States as of 4th January rose 4% on year, according to the data released by the Energy Information Administration. It was the highest level since February 2011.

US total petroleum supplies had been recorded 8 consecutive weeks of year-on-year increase before falling slightly in the latest EIA's weekly reports. However, gasoline supply has been decreasing on year over the past 7 weeks. Gasoline is accounted for 45% of total petroleum supply in the US.

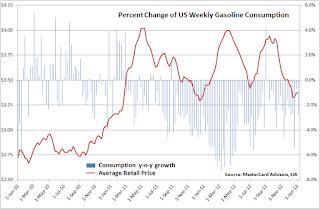

Weekly average gasoline consumption researched by MasterCard Advisors also shows year-on-year trend since March 2011. Retail price fluctuations seem not affect on consumption at the level of over $3 per gallon. The consumption survey recorded the year-on-year increase only once during the last year.

The following chart is comparing US weekly gasoline supply and production data provided by the EIA. Production exceeded supply in the late 2000's and the shortage was filled up by imports. US imported 1.0-1.6 million barrels per day of gasoline during the period.

Then gasoline supply began to exceed production in 2010's. The quantity subtracting supply from production had been minus before 2009 and have apparently changed to plus after 2010.

US imports about 0.5 million bpd of gasoline recently, while gasoline exports are more than 0.4 million bpd.

The reason of slump in gasoline demand is of course that people are reducing driving opportunities.

Monthly automobile sales in the US were stable between 16 and 18 million units since early 2000's, according to the Bureau of Economic Analysis, but the figures dropped during late 2007 and early 2009. The sales quantities were often below 10 million units in 2009.

Meanwhile, US car sales has started recovering since Q4 2009. The latest figures posted 15.3 million units that is close to the previous level.

However, the recovering automobile sales unfortunately does little to support gasoline demand.

Higher sales of hybrid cars or fuel-efficient cars seems to limit gasoline consumption. Car owners are also changing life style after the Lehman shock.

Since steady automobile sales could not support gasoline consumption, negative prediction is likely to dominate the market in the future.

May people of the US use more gasoline again if retail prices decline to below $2 per gallon?

No comments:

Post a Comment