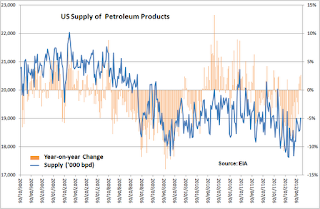

Supply of petroleum products in April in the United States fell 0.3% from a year ago, according to the monthly statistics by the American Petroleum Institute. The year-on-year change of U.S. petroleum products delivery has been negative for long period, but the numbers are gradually shrinking from month by month like 5.7% decrease in January, 2.3% drop in February and 1.3% dip in March.

Weekly statistics released by the Energy Information Administration has shown year-on-year increase in supply of U.S. petroleum products since the week ending 27th April. Therefore, supply in May might be higher than a year ago.

Petroleum products demand in the U.S. seems to have peaked out in February 2007. Then the demand is declining under the long-term tendency.

The weekly supply number declined to 17.62 million barrels per day in February this year. It was lower than the post Lehman shock slump level, and recorded the smallest demand since 1999.

However, the petroleum products demand has rebounded after February. Especially year-on-year growth in the past few weeks suggests possibility of changing tendency.

Off course, we may be able to think that recent weaker crude oil prices have sustained current steady petroleum demand, tentatively.... But, I guess that prices do not affect on supply of U.S. petroleum products significantly. Oil prices had a low correlation with demand during April and September 2011.

The long-term declining of the U.S. petroleum supplies has finished or not?

What does cause decrease of petroleum products demand? Low energy consumption by the change of social structures, or slow growth of economy, or shifting energy use triggered by higher oil prices and lower natural gas prices, etc.

Credit concerns following the Lehman shock and cheaper gas prices caused by the shale gas revolution have weighed on petroleum demand in the U.S. However, the demand might be bottoming out in the near term.

No comments:

Post a Comment