Since negotiation between Iran and 6 powers has not reached agreement last week, scheduled European Union sanction is likely to start in July.

The sanction will halt Iranian oil imports by EU member nations. Insurance or reinsurance on tanker carrying Iranian crude provided by European based insurance companies will be also prohibited.

Although Iranian crude imports by EU were above 600,000 barrels per day in late 2011, the volume declined to about 420,000 bpd in March this year. EU's Iranian crude oil import was estimated at about 350,000 bpd in April and further decrease are expected. Therefore, the embargo by EU is unlikely to affect on the market significantly.

Meanwhile, ban on marine insurance seems to reduce Iranian crude oil demand globally. Iran maintains more than 2 million bpd of crude oil exports toward mainly Asian nations such as India and China.

Japan was the biggest buyer of Iranian crude oil previously, but the country's Iranian crude oil imports from Iran in the first quarter 2012 decreased 22% on year to 320,000 bpd. South Korea has also reduced Iranian crude oil imports in line with western sanction.

India and China are not so cooperative to the western sanction like Japan or Korea, but China had cut Iranian crude oil imports during January and February due to the conflicts on price negotiation.

China imported 550,000 bpd of Iranian crude in 2011 but its average in Q1 2012 was only 260,000 bpd. Although April amount rebounded to 390,000 bpd, it was still 24% below the previous year level.

India has been the biggest consumer of Iranian crude oil since the beginning of this year. It's Q1 imports rose 23% on year to 430,000 bpd.

Marine insurance on most of Indian crude oil imports are provided by European firms.

Asian countries could keep transporting Iranian crude oil by using sovereign insurance. But only Japan is preparing the government insurance to cover for tanker transportation at this stage. Although China and India were reported to consider the government insurance, no concrete measure has been decided in those countries.

If China and India will continue steady imports by using the sovereign insurance, Iran is likely to keep 1.8 million bpd or more crude oil exports after July. But the volume may decline sharply due to the absence of insurance.

5.28.2012

5.21.2012

Is US petroleum demand bottomed out?

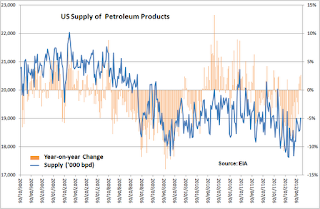

Supply of petroleum products in April in the United States fell 0.3% from a year ago, according to the monthly statistics by the American Petroleum Institute. The year-on-year change of U.S. petroleum products delivery has been negative for long period, but the numbers are gradually shrinking from month by month like 5.7% decrease in January, 2.3% drop in February and 1.3% dip in March.

Weekly statistics released by the Energy Information Administration has shown year-on-year increase in supply of U.S. petroleum products since the week ending 27th April. Therefore, supply in May might be higher than a year ago.

Petroleum products demand in the U.S. seems to have peaked out in February 2007. Then the demand is declining under the long-term tendency.

The weekly supply number declined to 17.62 million barrels per day in February this year. It was lower than the post Lehman shock slump level, and recorded the smallest demand since 1999.

However, the petroleum products demand has rebounded after February. Especially year-on-year growth in the past few weeks suggests possibility of changing tendency.

Off course, we may be able to think that recent weaker crude oil prices have sustained current steady petroleum demand, tentatively.... But, I guess that prices do not affect on supply of U.S. petroleum products significantly. Oil prices had a low correlation with demand during April and September 2011.

The long-term declining of the U.S. petroleum supplies has finished or not?

What does cause decrease of petroleum products demand? Low energy consumption by the change of social structures, or slow growth of economy, or shifting energy use triggered by higher oil prices and lower natural gas prices, etc.

Credit concerns following the Lehman shock and cheaper gas prices caused by the shale gas revolution have weighed on petroleum demand in the U.S. However, the demand might be bottoming out in the near term.

Weekly statistics released by the Energy Information Administration has shown year-on-year increase in supply of U.S. petroleum products since the week ending 27th April. Therefore, supply in May might be higher than a year ago.

Petroleum products demand in the U.S. seems to have peaked out in February 2007. Then the demand is declining under the long-term tendency.

The weekly supply number declined to 17.62 million barrels per day in February this year. It was lower than the post Lehman shock slump level, and recorded the smallest demand since 1999.

However, the petroleum products demand has rebounded after February. Especially year-on-year growth in the past few weeks suggests possibility of changing tendency.

Off course, we may be able to think that recent weaker crude oil prices have sustained current steady petroleum demand, tentatively.... But, I guess that prices do not affect on supply of U.S. petroleum products significantly. Oil prices had a low correlation with demand during April and September 2011.

The long-term declining of the U.S. petroleum supplies has finished or not?

What does cause decrease of petroleum products demand? Low energy consumption by the change of social structures, or slow growth of economy, or shifting energy use triggered by higher oil prices and lower natural gas prices, etc.

Credit concerns following the Lehman shock and cheaper gas prices caused by the shale gas revolution have weighed on petroleum demand in the U.S. However, the demand might be bottoming out in the near term.

5.13.2012

China energy use has gone into slow growth era

China's April industrial production index rose only 9.3% from a year ago, according to the National Bureau of Statistics. It was the first single digit growth since May 2009.

Year-on-year growth of electric power generation in the month was the lowest level since May 2009, and crude oil inputs were lower than a year ago.

Those downward tendencies have been clearly accelerated since mid-2011.

Growth of Industrial production in China stayed between 15-20% before mid-2008. The growth rate currently has declined to 10-15% after the turmoil caused by the Lehman shock. Growth of electric power generation also decreased to around 10% from previous 15%. Those numbers seem to be sinking further this year.

Meanwhile, the past 12 months growth of crude oil processing has remained below 5% level or even lower than a year ago.

Even if Chinese government continues to announce relatively steady growth of gross domestic production and business indices, China's energy consumption seems to have gone into the low growing era already.

We may be able to explain the sluggish growth as the change of energy consumption structure similar with U.S.

Petroleum use in the U.S. has been decreasing constantly since late 2010 without certain correlation with the nation's industrial activity.

However, China still significantly relies on manufacturing compared to U.S. or Japan.

Slow growth of energy consumption suggests current lower activity in factories and transportation sectors, if China has not succeeded to save energy dramatically.

If usual business cycle leads the sluggish growth of energy use, China may resume another round of steady growth rates. But energy consumption in the country is likely to decline in long-term, if manufacturers have begun to shift their facilities from China to other developing nations.

Year-on-year growth of electric power generation in the month was the lowest level since May 2009, and crude oil inputs were lower than a year ago.

Those downward tendencies have been clearly accelerated since mid-2011.

Growth of Industrial production in China stayed between 15-20% before mid-2008. The growth rate currently has declined to 10-15% after the turmoil caused by the Lehman shock. Growth of electric power generation also decreased to around 10% from previous 15%. Those numbers seem to be sinking further this year.

Meanwhile, the past 12 months growth of crude oil processing has remained below 5% level or even lower than a year ago.

Even if Chinese government continues to announce relatively steady growth of gross domestic production and business indices, China's energy consumption seems to have gone into the low growing era already.

We may be able to explain the sluggish growth as the change of energy consumption structure similar with U.S.

Petroleum use in the U.S. has been decreasing constantly since late 2010 without certain correlation with the nation's industrial activity.

However, China still significantly relies on manufacturing compared to U.S. or Japan.

Slow growth of energy consumption suggests current lower activity in factories and transportation sectors, if China has not succeeded to save energy dramatically.

If usual business cycle leads the sluggish growth of energy use, China may resume another round of steady growth rates. But energy consumption in the country is likely to decline in long-term, if manufacturers have begun to shift their facilities from China to other developing nations.

5.06.2012

Will Seaway pipeline reversal reduce Cushing stocks?

Crude oil stocks in Cushing Oklahoma as of 27th April reached to the historical record at 42.96 million barrels, according to the latest data by the U.S. Energy Information Administration.

Previous record was 41.9 million barrels posted in April 2011. Cushing inventories had decreased during May 2011 and January 2012 toward just above 28 million barrels level. The crude oil stocks have surged to the new record level over the past few months.

Cushing is a centre of petroleum refineries and crude oil transportation in the U.S. Midwest. Since physical delivery of NYMEX WTI futures contracts is done in the region, its inventory level is watched by market participants.

Crude oil produced in the U.S. southern region and imports arrived in Mexican Gulf coast are supplied to the Midwest area.

Moreover, Keystone pipeline has started delivering crude oil from Canada and North Dakota to Midwest since February last year. The fresh supply has been recognized as high inventory pressure in the Midwest region.

Crude oil imports into the Midwest region has certainly increased after mid-2011. But Cushing inventories were declining consistently during the later half of 2011 despite the increasing supply.

Also, growth of crude oil imports into the Midwest region remains in the same pace as previous, despite surged Cushing inventories in this year.

We can not see definite correlation between the supply and inventory...

Trends for crude oil imports in the U.S. each region also do not show apparent change. Imports into the Mexican gulf coast dipped in July last year from previous 5-6 million barrels per day to 4-5 million bpd and still have maintained that level.

Some people explain that recent higher Cushing inventories are preparing for the Seaway pipeline reversal scheduled to start operation in late May.

The pipeline was used to transport crude oil from Mexican gulf to Midwest, but the reversal operation is expected to reduce the inventory pressure in the Midwest area where has had no route to release crude oil.

The Seaway pipeline is scheduled to transport 150,000 bpd of crude oil in the beginning. The transportation volume is likely to increase to about 400,000 bpd by the 1Q 2013.

However, I am not sure whether the Seaway pipeline reversal will reduce Cushing inventories or not, because increased imports caused by the Keystone pipeline have not had certain correlation against the inventory level.

Previous record was 41.9 million barrels posted in April 2011. Cushing inventories had decreased during May 2011 and January 2012 toward just above 28 million barrels level. The crude oil stocks have surged to the new record level over the past few months.

Cushing is a centre of petroleum refineries and crude oil transportation in the U.S. Midwest. Since physical delivery of NYMEX WTI futures contracts is done in the region, its inventory level is watched by market participants.

Crude oil produced in the U.S. southern region and imports arrived in Mexican Gulf coast are supplied to the Midwest area.

Moreover, Keystone pipeline has started delivering crude oil from Canada and North Dakota to Midwest since February last year. The fresh supply has been recognized as high inventory pressure in the Midwest region.

Crude oil imports into the Midwest region has certainly increased after mid-2011. But Cushing inventories were declining consistently during the later half of 2011 despite the increasing supply.

Also, growth of crude oil imports into the Midwest region remains in the same pace as previous, despite surged Cushing inventories in this year.

We can not see definite correlation between the supply and inventory...

Trends for crude oil imports in the U.S. each region also do not show apparent change. Imports into the Mexican gulf coast dipped in July last year from previous 5-6 million barrels per day to 4-5 million bpd and still have maintained that level.

Some people explain that recent higher Cushing inventories are preparing for the Seaway pipeline reversal scheduled to start operation in late May.

The pipeline was used to transport crude oil from Mexican gulf to Midwest, but the reversal operation is expected to reduce the inventory pressure in the Midwest area where has had no route to release crude oil.

The Seaway pipeline is scheduled to transport 150,000 bpd of crude oil in the beginning. The transportation volume is likely to increase to about 400,000 bpd by the 1Q 2013.

However, I am not sure whether the Seaway pipeline reversal will reduce Cushing inventories or not, because increased imports caused by the Keystone pipeline have not had certain correlation against the inventory level.

Subscribe to:

Comments (Atom)