Crude oil processing by Chinese refineries rose 10.8% on year to 39.60 million tonnes in June, while petroleum products inventories as of end-June increased 2.1% from a month ago to 29.75 million tonnes. The inventory level also rose from a year earlier for the first time since January.

Because credibility against Chinese

statistics is not enough and some official data like inventory figures are not

announced, it is difficult to grasp actual petroleum consumption in the

country.

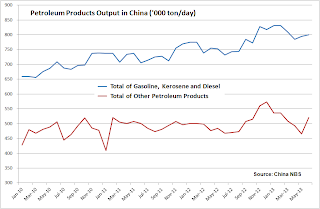

The following chart shows the estimated combined

monthly consumption of gasoline, kerosene and diesel. The figures are

calculated by production data released by the National Bureau of Statistics

with customs data and estimated inventories based on Xinhua News data.

The three products are account for about

60% of total petroleum products output in China, according to the International

Energy Agency. Therefore, chart's proportion of crude oil processing and the

three products outputs seem to be roughly correct.

According to the chart, consumption of

combined products is in relatively steady upward tendency compared to

fluctuating crude oil processing.

Especially, gasoline output shows quite

stable increase in the monthly data released by statistics bureau as well. However,

growth of diesel production, that is the biggest among three products, is

slowing down since 2010.

On the other hand, monthly outputs of other

petroleum products that include naphtha or fuel oil etc. are almost capped at

around 500,000 tonnes per day since 2010, except for surprising surge during

October 2012 and February 2013. Except for gasoline, growth of industrial

petroleum products demand in China seems to be slowing apparently.

Recently, Chinese government has ordered to

domestic 19 industries to discard old inefficient excess production facilities

by the end of September this year.

Since many of these facilities already have

been idling due to the over capacity, the disposal of facilities is unlikely to

reduce fuel consumption significantly. But the policy proves the sluggish

growth of fuel demand over the past couple of years caused by large excess

production capacity in the Chinese industrial sector.