China's domestic official petroleum prices are forecasted to rise again in early September following the recent price hike on 10th August.

Chinese domestic official petroleum prices are set by the government based on international market prices.

The prices have reduced 3 times during May and July after being raised twice in early this year. The latest change in this month was the first time price hike in five months.

Then, Chinese petroleum industry participants are predicting another price increase in the near future due to the recent overseas market movements.

Some market participants are expected to rush buying fuels before the price rise.

Domestic shipments of petroleum products increased in July as official price hike in early August was also expected. Stocks of petroleum products as of the end of July fell 5.9% from a month ago despite production in the month rose 5% from the previous month, according to the China National Bureau of Statistics.

Especially, month-end gas oil stocks fell by 8.1% from a month ago since its production in July posted only 3.9% increase from the previous month.

Gas oil consumption for on-site power generation was not strong in July due to relatively sufficient electricity supply. Also off-season for fisheries traditionally keeps gas oil demand lower in the month. Therefore, steady shipments in July seemed to related to temporary demand for rushing buy.

Further more temporary demand is likely to be seen toward the next price hike in September. Fishery season is going to resume and gas oil demand for agricultural machines is also increasing towards the harvest season.

However, despite those seasonal temporary demand, whole industrial gas oil demand seems to continue sluggish growth.

The declining growth of demand is seen in the domestic gas oil production figures in China, of course. On the other hand, downward-trend in Japan's exports to China also suggests sluggish industrial activities in China.

Japanese exports to China represent supply of materials, parts and machineries to manufacturers in China. Its decrease is none other than those shown a decline of Chinese industrial activities if China has not developed its own ability to produce those needed supplies rapidly.

Chinese petroleum demand may decline sharply after the temporary buying on expectation of price hike consumes future demand.

8.26.2012

8.19.2012

Is higher dependence on MidEast oil dangerous for US?

Dependence on imported crude oil from the Middle East by the United States is increasing this year. Does it deepen a threat on the US energy security in case of crisis in Hormuz strait?

Dependence on imported crude oil in the US had increased consecutively between 1980's and mid-2000's due to growth of demand and shrink domestic production.

Dependence on import, however, was capped in the latter half of 2000's in line with the faded regional petroleum demand. Then, recovering of domestic crude oil production reduces imports in 2010's.

Crude oil processing in the US was peaked out in 2007 and had decreased until early this year. Although the US petroleum demand is rebounding this year, additional supply of crude oil mainly comes from domestic oil fields.

While total crude oil imports stay unchanged, shipments from the Middle East showed steady increase. US dependence rate on crude oil from the Middle East rose to above 25% from the below 20% level.

It seems to be caused by Saudi Arabia and other OPEC member producers who have increased their production aggressively to make up for losing supply from Iran following the international sanctions against the nation that suspected nuclear development.

Actually, the increase of the US crude oil imports from the Middle East has been in step with OPEC's production.

Recent peak of Middle Eastern crude oil imports by the US was in early June, according to the Energy Information Administration. It matches with the fact that crude oil production by OPEC member nations had peaked out in April-May.

Decline of the Middle Eastern crude oil imports seems strange assuming that the US bought them for its definite necessity, because the US petroleum demand continues to increase even after June.

Therefore, the sudden increase of Middle East crude oil imports into the US since last year might suggest that the US absorbs excess supply from that region due to sluggish global demand.

On the other hand, crude oil stocks in the US Midwest area continued to increase even after the Seaway pipeline started reversal operations in May. Crude oil inventories in the area eventually stopped increasing after the peak out of imports from the Middle East. This also gives us an impression that the US does not need the additional Middle Eastern crude oil seriously.

If the increasing dependence on Middle Eastern crude oil by the US has such characteristics, the crisis at the Hormuz strait might not affect severely on the US energy security.

Dependence on imported crude oil in the US had increased consecutively between 1980's and mid-2000's due to growth of demand and shrink domestic production.

Dependence on import, however, was capped in the latter half of 2000's in line with the faded regional petroleum demand. Then, recovering of domestic crude oil production reduces imports in 2010's.

Crude oil processing in the US was peaked out in 2007 and had decreased until early this year. Although the US petroleum demand is rebounding this year, additional supply of crude oil mainly comes from domestic oil fields.

While total crude oil imports stay unchanged, shipments from the Middle East showed steady increase. US dependence rate on crude oil from the Middle East rose to above 25% from the below 20% level.

It seems to be caused by Saudi Arabia and other OPEC member producers who have increased their production aggressively to make up for losing supply from Iran following the international sanctions against the nation that suspected nuclear development.

Actually, the increase of the US crude oil imports from the Middle East has been in step with OPEC's production.

Recent peak of Middle Eastern crude oil imports by the US was in early June, according to the Energy Information Administration. It matches with the fact that crude oil production by OPEC member nations had peaked out in April-May.

Decline of the Middle Eastern crude oil imports seems strange assuming that the US bought them for its definite necessity, because the US petroleum demand continues to increase even after June.

Therefore, the sudden increase of Middle East crude oil imports into the US since last year might suggest that the US absorbs excess supply from that region due to sluggish global demand.

On the other hand, crude oil stocks in the US Midwest area continued to increase even after the Seaway pipeline started reversal operations in May. Crude oil inventories in the area eventually stopped increasing after the peak out of imports from the Middle East. This also gives us an impression that the US does not need the additional Middle Eastern crude oil seriously.

If the increasing dependence on Middle Eastern crude oil by the US has such characteristics, the crisis at the Hormuz strait might not affect severely on the US energy security.

8.12.2012

Japan's petroleum demand keeps retreat

Latest weekly crude oil throughput data released by the Petroleum Association of Japan was 3.47 million barrels per day in the week ended on 4th August.

The weekly crude oil processing data have recorded year-on-year decrease for 8 consecutive weeks since mid-June. It seems represent recent slump of petroleum demand in Japan.

The below chart shows monthly petroleum demand in Japan over the past several years.

Crude oil throughput is in the downward tendency, while domestic sales of gasoline has been relatively stable. The lack of nuclear power supply has lifted sales of fuel oil since mid-2011.

Therefore, main reason for sluggish of Japan's crude oil demand is thought as the slump in other industrial demand.

Power saving due to shut of nuclear plants has seriously affected on Japanese companies' activity. Slowdown of industrial activities also reduce petroleum consumption.

Electricity supply by the Japan's largest utility firm Tokyo Electric Power Company in July is estimated at 25.6 billion kilowatts hour, down 0.2% from a year ago.

Lower electricity generation firstly reduces fuel consumption for thermal power plants. Petroleum purchased by TEPCO decreased 9.2% on year to 4.28 million barrels in July.

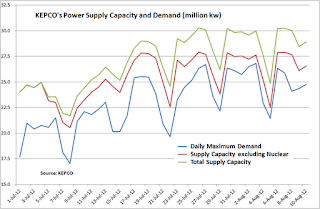

Meanwhile, daily maximum electricity demand in the area of Kansai Electric Power Company has been sufficiently lower than expected. The company restarted two of its nuclear reactors in July because it had forecasted significant electricity supply shortage during summer period. But until 10th August, the demand has not exceeded the supply capacity that does not include nuclear plants even once.

It suggests that KEPCO's petroleum use for thermal power remains in the lower than expected level.

This is also representing the effect of power saving. However, if the electricity demand in KEPCO's service area continues to be sufficiently below the supply capacity level until the end of summer season, anti-nuclear movements in Japan could escalate. Then the regional industrial sector is likely to be forced saving electricity for long period.

Sluggish industrial activities may hurt fuel demand further in the near future.

The weekly crude oil processing data have recorded year-on-year decrease for 8 consecutive weeks since mid-June. It seems represent recent slump of petroleum demand in Japan.

The below chart shows monthly petroleum demand in Japan over the past several years.

Crude oil throughput is in the downward tendency, while domestic sales of gasoline has been relatively stable. The lack of nuclear power supply has lifted sales of fuel oil since mid-2011.

Therefore, main reason for sluggish of Japan's crude oil demand is thought as the slump in other industrial demand.

Power saving due to shut of nuclear plants has seriously affected on Japanese companies' activity. Slowdown of industrial activities also reduce petroleum consumption.

Electricity supply by the Japan's largest utility firm Tokyo Electric Power Company in July is estimated at 25.6 billion kilowatts hour, down 0.2% from a year ago.

Lower electricity generation firstly reduces fuel consumption for thermal power plants. Petroleum purchased by TEPCO decreased 9.2% on year to 4.28 million barrels in July.

Meanwhile, daily maximum electricity demand in the area of Kansai Electric Power Company has been sufficiently lower than expected. The company restarted two of its nuclear reactors in July because it had forecasted significant electricity supply shortage during summer period. But until 10th August, the demand has not exceeded the supply capacity that does not include nuclear plants even once.

It suggests that KEPCO's petroleum use for thermal power remains in the lower than expected level.

This is also representing the effect of power saving. However, if the electricity demand in KEPCO's service area continues to be sufficiently below the supply capacity level until the end of summer season, anti-nuclear movements in Japan could escalate. Then the regional industrial sector is likely to be forced saving electricity for long period.

Sluggish industrial activities may hurt fuel demand further in the near future.

8.05.2012

Is India able to avoid electricity supply outage?

Recently,

India has suffered the historical scale blackouts. The country is likely to

cause further crisis in the near future since its historical growth of

electricity supply capacity is not enough to catch up with economic growth.

Electricity

output and power generation capacity in India have increased straightly over

the past few decades. But change of annual average utilization rates at Indian

power plants suggests electricity supply capacity has not increased enough

compared to rising demand. The utilization rate rose to more than 50% from

about 40% in 1980. Under such annual average rate, power plants seem to face

shortage risk of supply during the high demand season.

The

below chart is comparing growth rates between India and China. China's annual growth

of the Gross Domestic Product has mostly exceeded India's since mid 1980's.

Although

GDP growth rates show a similar trend between two emerging nations, annual

growth of electricity output in India is apparently lower than China after

2000's.

Average

growth rate of Chinese GDP during the first decade in the 21st century was 10%.

It was higher than India's 7%, and might had caused the different growth rates

of electricity supply between two nations. However, annual average growth of

India's electricity output during the same period was only 5% compared to 12%

in China.

It

is doubtful that India has been providing enough electricity supply capacity to

meet her own demand.

Ample

investments should be done into the electricity supply sector, if India needs

stable economic growth.

Thermal

power plants have attracted larger part of investments into the Indian power

utility sector in the past three decades. Thermal power's share among India's

total power generation capacity was 60% in 1980, but it has risen to 70% now.

Indian

thermal power plants are relying on coal as their fuel. About 75% of regional

coal supply is consumed by the electricity sector.

Even

if India is a coal producing country, domestic production has not covered its

rapid growth of coal demand after mid-1990's. Imports are increasing year by

year.

Coal

imports are accelerating in 2010's especially, because the growth of domestic

production has slowed down. That is likely to cause another problem in the near

future.

Subscribe to:

Comments (Atom)