Change of the global petroleum supply and demand structure that was caused by the shale revolution has been obvious this year.

Shale oil production increased especially in North America and influenced significantly on local crude oil prices. The U.S. Energy Information Administration chose Brent crude instead of domestic WTI for reference price in its long-term forecast report for the first time, since the domestic marker price has been far different from other international marker prices.

World petroleum demand exceeded supply during 2011 due to the supply disruption caused by the Arab Spring and the Libyan civil war, but the supply became excess in 2012. Although OPEC member countries reduced output in the later half of this year, average supply and demand balance in 2012 is estimated at 50,000 barrels per day of excess by the EIA.

Meanwhile, EIA forecasts 50,000 bpd of supply shortage in 2013. But OPEC and International Energy Agency still predict slight oversupply in the next year. (see the table)

OPEC and IEA do not give forecasts for total global petroleum supply figures. But we can calculate necessary OPEC crude oil by using their prediction on global demand and petroleum supply excluding OPEC crude.

According to both organizations' figures, needed OPEC crude oil supply in 2013 are estimated below the current production quota of 30 million bpd.

Latest estimation on OPEC crude production are between 30.5 million bpd and more than 31 million bpd. So, global petroleum supply could be excess if OPEC members do not continue to reduce supply further.

However, we have not seen less OPEC output than production quota for long. Therefore, global petroleum market is likely to be slight oversupply in 2013.

On the other hand, that oversupply is unlikely to move the crude oil prices.

Oversupply of 1.6 million bpd caused crude oil prices to sink to the lowest level in past 3 decades in 1998, while the market was supply shortage of 1.6 million bpd before crude oil prices reached the historical record in 2008.

The gap between global oil supply and demand in the next year is expected at about several tenth thousand bpd, and such small figures won't influence on the crude oil market.

Global petroleum supply was capped at around 85 million bpd in the later half of 2000's. The limit of traditional crude oil production seemed to be one of the reasons of crude oil price surge during 2007-2008.

The shale revolution has already removed the limit.

Since the shale revolution is also boosting natural gas production all over the world, the global consumption structure of fossil fuel is changing as well.

Crude oil prices are unlikely to be supported by supply factors in the future, except for severe supply disruption by the war or a case of significant environmental regulations against shale oil/gas development.

Introduction of strict regulation on energy production seems to be quite difficult, as offshore oilfield developments are still ongoing globally despite the shocking oil spill in the Gulf of Mexico in 2010. The shale revolution is unlikely to be retracted.

12.30.2012

12.23.2012

Economic recovery urges nuke plants resumption in Japan

Japanese utility firms ceased all nuclear power plants in June this year due to the anti-nuclear movements following the severe accident in Fukushima. Then Kansai Electric Power company has only restarted two units.

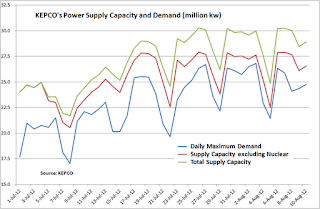

Most power companies got over the high-demand season during summer without nuclear units. Electricity demand in the KEPCO's service area during the summer season was also less than the supply capacity except for restarted nuclear plants.

These results encouraged anti-nuclear movements, but the stable power supply without nuclear units have been supported by not only the effort of power saving but also by the continued economy decline.

Year-on-year growth of Japan's industrial production shows decrease in most of the months in this year except for during March and May when figures are compared to the turmoil period after the severe earthquake. It is natural that the power demand in this year is also decreasing.

If Japanese economy continues to shrink further, electricity demand will also decrease and nuclear plants are no longer needed.

However, December's Monthly Economic Report by the Cabinet Office changed the overall economy outlook to "unchanged". The report had told downward revisions in the past four months.

Although exports and capital investments are still in weak tendency, individual consumption seems to show sign of recovery.

Easing monetary policy in order to exit from deflation is also expected to stimulate the Japanese economy, therefore, the risk of further economic recession seems to be relatively decreasing.

Current recovering energy usage in Japan seems to be reacting to the situation. Crude oil processing volume posted increase on year in the recent two weeks after the previous slump, according to the Petroleum Association of Japan. Electricity supply in November rose for the first time in the past three months, according the to the Federation of Electric Power Companies.

On the other hand, KEPCO's daily maximum power demand exceeded the supply capacity excluding nuclear plants in couple of days in December. It means that the company failed supplying enough electricity without nuclear units.

The insufficient supply capacity was caused by unexpected higher power demand due to the chilly weather besides maintenance shutdown at thermal power units. The company cannot do enough maintenance at thermal power plants if it keeps ceasing nuclear units.

Two giant utility firms Tokyo Electric Power Company and KEPCO kept power supply reserve rate at above 10% until summer season, but recently these figures often decline to single digit. Especially, TEPCO doesn't have enough capacity. If economic recovery will boost electricity demand, supply shortage is likely to occur.

Since Japanese electricity demand does not seem to surge by two digits numbers continuously even in the economic recovery period, utility firms could be able to keep enough power supply without nuclear units in the near term.

However, the continual stable power supply would definitely require further economic decline, if Japan does not prepare enough alternative power supply source such as new gas-burning thermal power units.

Most power companies got over the high-demand season during summer without nuclear units. Electricity demand in the KEPCO's service area during the summer season was also less than the supply capacity except for restarted nuclear plants.

These results encouraged anti-nuclear movements, but the stable power supply without nuclear units have been supported by not only the effort of power saving but also by the continued economy decline.

Year-on-year growth of Japan's industrial production shows decrease in most of the months in this year except for during March and May when figures are compared to the turmoil period after the severe earthquake. It is natural that the power demand in this year is also decreasing.

If Japanese economy continues to shrink further, electricity demand will also decrease and nuclear plants are no longer needed.

However, December's Monthly Economic Report by the Cabinet Office changed the overall economy outlook to "unchanged". The report had told downward revisions in the past four months.

Although exports and capital investments are still in weak tendency, individual consumption seems to show sign of recovery.

Easing monetary policy in order to exit from deflation is also expected to stimulate the Japanese economy, therefore, the risk of further economic recession seems to be relatively decreasing.

Current recovering energy usage in Japan seems to be reacting to the situation. Crude oil processing volume posted increase on year in the recent two weeks after the previous slump, according to the Petroleum Association of Japan. Electricity supply in November rose for the first time in the past three months, according the to the Federation of Electric Power Companies.

On the other hand, KEPCO's daily maximum power demand exceeded the supply capacity excluding nuclear plants in couple of days in December. It means that the company failed supplying enough electricity without nuclear units.

The insufficient supply capacity was caused by unexpected higher power demand due to the chilly weather besides maintenance shutdown at thermal power units. The company cannot do enough maintenance at thermal power plants if it keeps ceasing nuclear units.

Two giant utility firms Tokyo Electric Power Company and KEPCO kept power supply reserve rate at above 10% until summer season, but recently these figures often decline to single digit. Especially, TEPCO doesn't have enough capacity. If economic recovery will boost electricity demand, supply shortage is likely to occur.

Since Japanese electricity demand does not seem to surge by two digits numbers continuously even in the economic recovery period, utility firms could be able to keep enough power supply without nuclear units in the near term.

However, the continual stable power supply would definitely require further economic decline, if Japan does not prepare enough alternative power supply source such as new gas-burning thermal power units.

12.16.2012

Is Chinese economy really recovering?

Recently, Chinese economic data show recovering. Since exports are still in slump, analysts describe that these positive changes have been led by the domestic demand.

HSBC's December manufacturing PMI was 50.9, the highest figure in the past 14 months. Industrial production in November posted the first two digits growth since March, according to the National Bureau of Statistics.

Energy consumption is also rising in step with the recovering economic data. Year-on-year growth of Chinese electricity output remained below 3% during the second and third quarter, but it rose to 6.4% in October and to 7.9% in November. It suggests revitalizing industrial activities.

Crude oil processing in China rose only 1.6% from a year ago during the first eight months in this year, but the growth rate increased to 7.0% in September and to 6.7% in October then to 9.1% in November.

Monthly petroleum products output tells us that surging gasoline and gas oil production suggest strong demand from the transportation sector.

Meanwhile, the balance between crude oil supply and processing apparently shows shortage of supply in the past couple of months. This means current increased crude oil processing in China is not a pre-planned activity.

Previously, monthly shortage was solved with averaging with previous and next months. However, recent consecutive shortage is likely reducing crude oil inventories in China.

Crude oil stocks excluding strategic reserve as of the end-October fell 3.5% from a month ago, according to Xinhua News. The inventory level seemed to decrease further in November.

Incidentally, the ample excess supply in the first half of this year was caused by the installation of 80 million barrels strategic reserve into the newly built facilities.

If domestic demand really leads economic recovery, China will have to import more crude oil to meet high processing. Import volumes in December and January may tell us the change.

On the other hand, Chinese government is scheduled to introduce a new petroleum consumption tax on 1st January 2013. The tax rate for fuel is 0.8 RMB per liter. Since current prices of regular gasoline are around 7.5 RMB per liter, pump prices will rise more than 10% after 1st January.

Rush demand before the enforcement of the new tax might be one of the reason of recent high petroleum demand. In that case, the demand is likely to shrink after January.

HSBC's December manufacturing PMI was 50.9, the highest figure in the past 14 months. Industrial production in November posted the first two digits growth since March, according to the National Bureau of Statistics.

Energy consumption is also rising in step with the recovering economic data. Year-on-year growth of Chinese electricity output remained below 3% during the second and third quarter, but it rose to 6.4% in October and to 7.9% in November. It suggests revitalizing industrial activities.

Crude oil processing in China rose only 1.6% from a year ago during the first eight months in this year, but the growth rate increased to 7.0% in September and to 6.7% in October then to 9.1% in November.

Monthly petroleum products output tells us that surging gasoline and gas oil production suggest strong demand from the transportation sector.

Meanwhile, the balance between crude oil supply and processing apparently shows shortage of supply in the past couple of months. This means current increased crude oil processing in China is not a pre-planned activity.

Previously, monthly shortage was solved with averaging with previous and next months. However, recent consecutive shortage is likely reducing crude oil inventories in China.

Crude oil stocks excluding strategic reserve as of the end-October fell 3.5% from a month ago, according to Xinhua News. The inventory level seemed to decrease further in November.

Incidentally, the ample excess supply in the first half of this year was caused by the installation of 80 million barrels strategic reserve into the newly built facilities.

If domestic demand really leads economic recovery, China will have to import more crude oil to meet high processing. Import volumes in December and January may tell us the change.

On the other hand, Chinese government is scheduled to introduce a new petroleum consumption tax on 1st January 2013. The tax rate for fuel is 0.8 RMB per liter. Since current prices of regular gasoline are around 7.5 RMB per liter, pump prices will rise more than 10% after 1st January.

Rush demand before the enforcement of the new tax might be one of the reason of recent high petroleum demand. In that case, the demand is likely to shrink after January.

12.09.2012

Does Asia really need US LNG export?

The United States government is considering to expand liquefied natural gas exports. North American natural gas prices have been in slump in the past couple of years due to the oversupply caused by the shale gas production.

Natural gas is globally oversupplied basically, while steady growth in China and the urgent need for thermal power due to nuclear power shortage in Japan make East Asian gas prices higher than other regions.

Increasing LNG supply from the US is likely to reduce Asian gas prices through arbitrage.

However, US LNG export won't surge immediately after the deregulation. Further LNG shipments require new gas-liquefy facilities and loading infrastructures as well as LNG carriers.

Long-term energy forecast recently provided by the Energy Information Administration predicts that the US natural gas import/export balance won't be export excess until 2020. Then gas export excess is expected to increase despite steady growth of domestic demand. US gas exports are forecasted to exceed imports 55 billion cubic meters in 2030, and exceed 95 bcf in 2040.

Natural gas prices in North America, that has been depressed by oversupply, are also expected to rise in line with the change of fundamentals. Protesters against the deregulation who afraid about higher domestic energy prices might be right.

On the other hand, even if the US increased its LNG exports, Japan may not buy a lot.

Why? As many people know, Japan has hiked LNG consumption for thermal power after the severe earthquake in March 2011 in order to make up for nuclear power shortage.

Japan's LNG imports in 2011 rose 12.2% from a year ago to 78.5 million tonnes, according to the customs data. Imports in the first ten months in this year increased 13% on year to 72.9 million tonnes. Total LNG imports in 2012 are seen to be around 87 million tonnes or 120 bcf.

Japan's LNG purchase, however, won't increase further in 2013. The country's existing LNG unloading and storage capacities won't allow to accept more imports. It's already reached to the physical ceiling.

Power saving, economic slump or resume of nuclear power plants are likely to reduce Japan's natural gas consumption in 2013 rather than increasing.

In Japan, annual 1 million tonnes of a new LNG import terminal is planned to be built in Fukushima prefecture by 2018. A 200,000 tonnes new storage facility is also planned to be installed in Hokkaido. But any other big concrete plans for LNG import infrastructure are not announced.

Meanwhile, China has been the biggest LNG consumer in Asia since 2009. Its growth of LNG demand in 2011 exceeded Japan even though the urgent demand for thermal power boosted Japan's gas consumption.

China's natural gas consumption in the first nine months 2012 rose 13.6% on year to 106.5 bcm, according to the National Development and Reform Commission. Total demand in 2012 is seen to be about 147.7 bcm. China's LNG imports in January-September surged 35.5% from a year ago to 30.5 bcm.

If China is able to continue economic growth as the government anticipated, the country's natural gas demand in 2015 is forecasted to reach to 230 bcm. But, China may not eager to look for fresh import contracts, since its gas supply capacity (domestic production and long-term import contracts) are predicted at 260 bcm in the same year.

Middle Eastern natural gas supply is also expected to increase firmly, so Asian natural gas market is likely to be already oversupply when the US will start shipping LNG to the region earnestly.

Natural gas is globally oversupplied basically, while steady growth in China and the urgent need for thermal power due to nuclear power shortage in Japan make East Asian gas prices higher than other regions.

Increasing LNG supply from the US is likely to reduce Asian gas prices through arbitrage.

However, US LNG export won't surge immediately after the deregulation. Further LNG shipments require new gas-liquefy facilities and loading infrastructures as well as LNG carriers.

Long-term energy forecast recently provided by the Energy Information Administration predicts that the US natural gas import/export balance won't be export excess until 2020. Then gas export excess is expected to increase despite steady growth of domestic demand. US gas exports are forecasted to exceed imports 55 billion cubic meters in 2030, and exceed 95 bcf in 2040.

Natural gas prices in North America, that has been depressed by oversupply, are also expected to rise in line with the change of fundamentals. Protesters against the deregulation who afraid about higher domestic energy prices might be right.

On the other hand, even if the US increased its LNG exports, Japan may not buy a lot.

Why? As many people know, Japan has hiked LNG consumption for thermal power after the severe earthquake in March 2011 in order to make up for nuclear power shortage.

Japan's LNG imports in 2011 rose 12.2% from a year ago to 78.5 million tonnes, according to the customs data. Imports in the first ten months in this year increased 13% on year to 72.9 million tonnes. Total LNG imports in 2012 are seen to be around 87 million tonnes or 120 bcf.

Japan's LNG purchase, however, won't increase further in 2013. The country's existing LNG unloading and storage capacities won't allow to accept more imports. It's already reached to the physical ceiling.

Power saving, economic slump or resume of nuclear power plants are likely to reduce Japan's natural gas consumption in 2013 rather than increasing.

In Japan, annual 1 million tonnes of a new LNG import terminal is planned to be built in Fukushima prefecture by 2018. A 200,000 tonnes new storage facility is also planned to be installed in Hokkaido. But any other big concrete plans for LNG import infrastructure are not announced.

Meanwhile, China has been the biggest LNG consumer in Asia since 2009. Its growth of LNG demand in 2011 exceeded Japan even though the urgent demand for thermal power boosted Japan's gas consumption.

China's natural gas consumption in the first nine months 2012 rose 13.6% on year to 106.5 bcm, according to the National Development and Reform Commission. Total demand in 2012 is seen to be about 147.7 bcm. China's LNG imports in January-September surged 35.5% from a year ago to 30.5 bcm.

If China is able to continue economic growth as the government anticipated, the country's natural gas demand in 2015 is forecasted to reach to 230 bcm. But, China may not eager to look for fresh import contracts, since its gas supply capacity (domestic production and long-term import contracts) are predicted at 260 bcm in the same year.

Middle Eastern natural gas supply is also expected to increase firmly, so Asian natural gas market is likely to be already oversupply when the US will start shipping LNG to the region earnestly.

12.02.2012

How much is global oil market oversupplied?

Global petroleum supply has exceeded demand since early this year, contrast to the shortage in the last year. Sluggish growth of demand while ample supply caused the situation. But how much is global petroleum market oversupplied at moment?

World balance of petroleum supply and demand was matched in 2009, but it turned to the shortage of supply due to the global economic recovery in 2010. Then, Libyan civil war suddenly stopped 1.6 million barrels per day of crude oil supply last year and led the global oil market to the significant shortage.

Urgent hike of output by producing countries made up for the shortage, and Libyan production has recovered quite faster than expected. Therefore, the decreasing crude oil supply from Iran by more than 1 million bpd due to the international sanction did not cause another shortage of supply in the global market.

The following table shows global balance of petroleum supply and demand based on data supplied by the U.S. Energy Information Administration, the Organization of Petroleum Exporting Countries and the International Energy Agency.

Except for EIA's estimate for 3Q 2012, that shows supply shortage due to steady demand, estimates and forecasts for 2012 and Q1 2013 are oversupply.

Meanwhile, EIA forecasts another round of oversupply in Q4 2012 and Q1 2013.

OPEC and IEA do not supply forecasts for OPEC member nations crude oil output yet. Relatively large minus figures in the balance cells in the table indicate necessary amount of OPEC crude oil supply in those periods.

Since recent crude oil output by OPEC is about 31 million bpd, that is much higher than the necessary volume, the supply shortage is unlikely to be seen until OPEC members decide to cut production significantly from the current level.

In the latest monthly report, OPEC has estimated October production by its 12 member countries at 30.95 million bpd and saw the world petroleum supply at 90.22 million bpd. IEA also estimated OPEC October crude oil output at 31.16 million bpd and assessed the world oil supply at 90.92 million bpd. Those numbers are all exceeding the demand forecasts for Q4.

On the other hand, Reuters earlier reported the survey result that OPEC crude oil output in November fell by 90,000 bpd from the previous month, and Bloomberg estimated the OPEC production declined by 330,000 bpd from a month ago.

Even if OPEC production decreases by 200,000 to 300,000 bpd from the October level, global balance of oil supply and demand estimated by OPEC or IEA still stays in oversupply.

It's true that recent volume of petroleum oversupply is shrinking compared to the first half of this year. The fact slightly confuses us. Why current crude oil prices are lower than the first half of this year? The market may have discounted the future slump of demand....

World balance of petroleum supply and demand was matched in 2009, but it turned to the shortage of supply due to the global economic recovery in 2010. Then, Libyan civil war suddenly stopped 1.6 million barrels per day of crude oil supply last year and led the global oil market to the significant shortage.

Urgent hike of output by producing countries made up for the shortage, and Libyan production has recovered quite faster than expected. Therefore, the decreasing crude oil supply from Iran by more than 1 million bpd due to the international sanction did not cause another shortage of supply in the global market.

The following table shows global balance of petroleum supply and demand based on data supplied by the U.S. Energy Information Administration, the Organization of Petroleum Exporting Countries and the International Energy Agency.

Except for EIA's estimate for 3Q 2012, that shows supply shortage due to steady demand, estimates and forecasts for 2012 and Q1 2013 are oversupply.

Meanwhile, EIA forecasts another round of oversupply in Q4 2012 and Q1 2013.

OPEC and IEA do not supply forecasts for OPEC member nations crude oil output yet. Relatively large minus figures in the balance cells in the table indicate necessary amount of OPEC crude oil supply in those periods.

Since recent crude oil output by OPEC is about 31 million bpd, that is much higher than the necessary volume, the supply shortage is unlikely to be seen until OPEC members decide to cut production significantly from the current level.

In the latest monthly report, OPEC has estimated October production by its 12 member countries at 30.95 million bpd and saw the world petroleum supply at 90.22 million bpd. IEA also estimated OPEC October crude oil output at 31.16 million bpd and assessed the world oil supply at 90.92 million bpd. Those numbers are all exceeding the demand forecasts for Q4.

On the other hand, Reuters earlier reported the survey result that OPEC crude oil output in November fell by 90,000 bpd from the previous month, and Bloomberg estimated the OPEC production declined by 330,000 bpd from a month ago.

Even if OPEC production decreases by 200,000 to 300,000 bpd from the October level, global balance of oil supply and demand estimated by OPEC or IEA still stays in oversupply.

It's true that recent volume of petroleum oversupply is shrinking compared to the first half of this year. The fact slightly confuses us. Why current crude oil prices are lower than the first half of this year? The market may have discounted the future slump of demand....

11.25.2012

Is China able to dominate global oil price?

Chinese crude oil futures market was earlier announced to launch by the end of this year, but currently it is expected to be started in 2013.

China aims to affect on global commodities pricing by using its own futures market. Success of crude oil futures seems to be the big milestone for the Chinese ambition.

Detailed specifications for the crude oil contract on the Shanghai Futures Exchange have not released yet. But market sources tell that the trading unit is 100 barrels, which is one tenth of WTI or Brent futures, and prices are set by every 0.1 RMB per barrel.

On the other hand, traded crude oil is estimated API 32 degree with 1.5% sulphur content. Since Chinese domestic produced oil is much lower sulphur content than that, Middle Eastern medium crude oil such as Arabian Light are likely to be the target.

Production volume of Arabian Light crude oil is over 4 million barrels per day, extremely larger than about 0.8 million bpd of Middle Eastern marker crude oil Dubai/Oman.

However, most of Middle Eastern crude oil are sold under long-term contracts, and have strict limitation to resale. Physical delivery for the futures contract may have difficulties.

Meanwhile, Chinese government has changed regulations for the futures market prior to the launch of crude oil contracts. Foreign institutions now can trade Chinese domestic futures contracts directly. Previously, foreign companies only had indirect connection with local Chinese market by capital investment.

Shanghai crude oil futures market is scheduled to provide US dollar denominated trade for foreign participants besides RMB denominated market for domestic players.

The relationship between the dollar denominated market and the RMB based market is still not clear. But supplying easy environment of arbitrage with overseas markets is quite important to activate the Shanghai market.

Daily trading volume should be recognized as more important matter. East Asia already has a Middle Eastern crude oil futures market in the Tokyo Commodity Exchange, but the Japanese market is ignored from global markets due to the sluggish trading volume.

TOCOM once influenced global precious metals markets because of large trading volume by private investors' active participation. But investors' attention has shifted from commodity futures to other market by Japanese government's regulations.

In China, many local brokers are planning to provide paper crude oil trading to investors. Those investment tools will be based on Shanghai futures market. Plenty investment money will provide good opportunities for arbitrage deals with overseas market.

If Chinese brokerage firms succeed to attract active investment into the new crude oil futures market, China is likely to have certain influence on global oil price decision mechanism. However, further economic recession and possible shrink of investment money may hamper the plan.

China aims to affect on global commodities pricing by using its own futures market. Success of crude oil futures seems to be the big milestone for the Chinese ambition.

Detailed specifications for the crude oil contract on the Shanghai Futures Exchange have not released yet. But market sources tell that the trading unit is 100 barrels, which is one tenth of WTI or Brent futures, and prices are set by every 0.1 RMB per barrel.

On the other hand, traded crude oil is estimated API 32 degree with 1.5% sulphur content. Since Chinese domestic produced oil is much lower sulphur content than that, Middle Eastern medium crude oil such as Arabian Light are likely to be the target.

Production volume of Arabian Light crude oil is over 4 million barrels per day, extremely larger than about 0.8 million bpd of Middle Eastern marker crude oil Dubai/Oman.

However, most of Middle Eastern crude oil are sold under long-term contracts, and have strict limitation to resale. Physical delivery for the futures contract may have difficulties.

Meanwhile, Chinese government has changed regulations for the futures market prior to the launch of crude oil contracts. Foreign institutions now can trade Chinese domestic futures contracts directly. Previously, foreign companies only had indirect connection with local Chinese market by capital investment.

Shanghai crude oil futures market is scheduled to provide US dollar denominated trade for foreign participants besides RMB denominated market for domestic players.

The relationship between the dollar denominated market and the RMB based market is still not clear. But supplying easy environment of arbitrage with overseas markets is quite important to activate the Shanghai market.

Daily trading volume should be recognized as more important matter. East Asia already has a Middle Eastern crude oil futures market in the Tokyo Commodity Exchange, but the Japanese market is ignored from global markets due to the sluggish trading volume.

TOCOM once influenced global precious metals markets because of large trading volume by private investors' active participation. But investors' attention has shifted from commodity futures to other market by Japanese government's regulations.

In China, many local brokers are planning to provide paper crude oil trading to investors. Those investment tools will be based on Shanghai futures market. Plenty investment money will provide good opportunities for arbitrage deals with overseas market.

If Chinese brokerage firms succeed to attract active investment into the new crude oil futures market, China is likely to have certain influence on global oil price decision mechanism. However, further economic recession and possible shrink of investment money may hamper the plan.

11.18.2012

Further slump of Japan's energy demand

Japan's energy consumption is decreasing further. The country's industrial utilization rate has recorded four consecutive months year-on-year decrease since June, and its GDP growth rate fell 3.5% on year in the third quarter. Moreover, current sluggish energy demand suggests further slump of industrial activities.

Weekly crude oil processing data announced by the Petroleum Association of Japan is sinking deeply after the last week of October. The latest number was 8.4% decrease on year, the biggest decline since January this year.

The January change was based on comparison to the period when the severe earthquake still had not damaged Japanese economy. Meanwhile recent figures are change from post-quake crude oil processing.

Although fuel oil demand for thermal power generation has surged in Japan due to the shortage of nuclear power supply, total petroleum demand is decreasing. It means demand for gasoline, diesel and other petroleum products is significantly weaker.

Shutdowns at nationwide nuclear power plants are weighing on electricity consumption in Japan, however, fears about power supply shortage are fading after the country got over the summer without nuclear power.

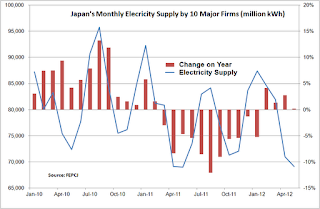

Since power demand is in very low level during autumn typically, Japanese electricity consumers are able to use power without any worries. But Japan's electricity demand fell 1.8% on year in October after recorded 0.4% on year decrease in September, according to the Federation of Electric Power Companies.

Then, combined electricity supply by three major utility firms in the first half of November fell 3.0% from a year ago. Total power supply by Tokyo Electric Power, Kansai Electric Power and Chubu Electric Power accounts for about 60% of entire Japan's supply.

Current situation of energy demand seems to be realizing the predictions of further decline of Japanese GDP growth in the 4Q. Will the result of coming general election change the downward tendency?

Weekly crude oil processing data announced by the Petroleum Association of Japan is sinking deeply after the last week of October. The latest number was 8.4% decrease on year, the biggest decline since January this year.

The January change was based on comparison to the period when the severe earthquake still had not damaged Japanese economy. Meanwhile recent figures are change from post-quake crude oil processing.

Although fuel oil demand for thermal power generation has surged in Japan due to the shortage of nuclear power supply, total petroleum demand is decreasing. It means demand for gasoline, diesel and other petroleum products is significantly weaker.

Shutdowns at nationwide nuclear power plants are weighing on electricity consumption in Japan, however, fears about power supply shortage are fading after the country got over the summer without nuclear power.

Since power demand is in very low level during autumn typically, Japanese electricity consumers are able to use power without any worries. But Japan's electricity demand fell 1.8% on year in October after recorded 0.4% on year decrease in September, according to the Federation of Electric Power Companies.

Then, combined electricity supply by three major utility firms in the first half of November fell 3.0% from a year ago. Total power supply by Tokyo Electric Power, Kansai Electric Power and Chubu Electric Power accounts for about 60% of entire Japan's supply.

Current situation of energy demand seems to be realizing the predictions of further decline of Japanese GDP growth in the 4Q. Will the result of coming general election change the downward tendency?

11.11.2012

Japan's power saving weigh on Chinese trade

China's crude oil imports in October rose 13.8% on year to 5.6 million barrels per day, according to the customs data. The country's crude oil processing in the month was 6.7% higher than a year ago and electricity output rose 6.4% on year as well. These energy related data were relatively stronger than slump during past several months.

However, Chinese energy consumption is still significantly weaker than previously recorded two digits stable growth. Current situation is no more than barely avoiding flat or minus growth.

Since year-on-year growth of monthly China's energy demand in this year have been sluggish, let's take a look at change compared to the same months of 2010.

Growth rates of crude oil processing and processing trade amount are apparently down after April.

On the other hand, Japanese data, which are confused in case of year-on-year due to the severe earthquake, also show clear downward tendency when compared to 2010.

The reason why Japan's crude oil processing rose from a year ago in June seemed to be affected by lower Chinese crude oil throughputs due to the poor refining margin.

The notable point is continuous decrease of electricity output in Japan since March. It seemed to be caused by nationwide power saving because of a lack of power supply capacity due to the nuclear plants shutdown. Japan's entire nuclear power units were shutdown in June and resumed only two later.

China's processing trade is reducing its growth pace in step with the slowdown of Japanese power output.

The processing trade, which accounts for 35% of total trade of China, is one of the major methods to earn foreign currency for the country. The amount of the processing trade was increased by 12.7% from a year ago in 2011, but the growth rate shrinked to 2.5% on year in the first ten months in 2012. The monthly growth data compared with 2010 are in relatively lower level after April.

Chinese processing trade hit all-time record in November last year and has never exceeded after that. We can't ignore influence by Japan's sluggish power consumption against processing trade in China.

Of course, weaker demand for materials, parts and machineries from China may make Japanese manufacturers easy to cut power use.

China's total trade in Jan-Oct rose 6.3% from a year earlier, according to the customs data. The number is much lower than 22.5% on year growth in 2011. Especially, trade with Japan fell 2.1% on year and trade with EU decreased 3.0% on year during the first 10 months in this year.

China's imports from Japan in October fell 10.2% from a year ago. Media explain that the conflict between both nations over islands in the East China sea is affecting on the trade. However, Japan's exports to China had already fallen 9.2% on year during Jan-Aug period before breaking out the dispute.

However, Chinese energy consumption is still significantly weaker than previously recorded two digits stable growth. Current situation is no more than barely avoiding flat or minus growth.

Since year-on-year growth of monthly China's energy demand in this year have been sluggish, let's take a look at change compared to the same months of 2010.

Growth rates of crude oil processing and processing trade amount are apparently down after April.

On the other hand, Japanese data, which are confused in case of year-on-year due to the severe earthquake, also show clear downward tendency when compared to 2010.

The reason why Japan's crude oil processing rose from a year ago in June seemed to be affected by lower Chinese crude oil throughputs due to the poor refining margin.

The notable point is continuous decrease of electricity output in Japan since March. It seemed to be caused by nationwide power saving because of a lack of power supply capacity due to the nuclear plants shutdown. Japan's entire nuclear power units were shutdown in June and resumed only two later.

China's processing trade is reducing its growth pace in step with the slowdown of Japanese power output.

The processing trade, which accounts for 35% of total trade of China, is one of the major methods to earn foreign currency for the country. The amount of the processing trade was increased by 12.7% from a year ago in 2011, but the growth rate shrinked to 2.5% on year in the first ten months in 2012. The monthly growth data compared with 2010 are in relatively lower level after April.

Chinese processing trade hit all-time record in November last year and has never exceeded after that. We can't ignore influence by Japan's sluggish power consumption against processing trade in China.

Of course, weaker demand for materials, parts and machineries from China may make Japanese manufacturers easy to cut power use.

China's total trade in Jan-Oct rose 6.3% from a year earlier, according to the customs data. The number is much lower than 22.5% on year growth in 2011. Especially, trade with Japan fell 2.1% on year and trade with EU decreased 3.0% on year during the first 10 months in this year.

China's imports from Japan in October fell 10.2% from a year ago. Media explain that the conflict between both nations over islands in the East China sea is affecting on the trade. However, Japan's exports to China had already fallen 9.2% on year during Jan-Aug period before breaking out the dispute.

11.04.2012

China's energy supply capacity is already excess?

Energy demand typically increases in the fourth quarter in China. A lack of petroleum supply caused severe turmoil in the Chinese society during the 4Q period in past two years.

However, similar supply disruption has not heard this year. Significant shortage of electricity supply capacity during demand seasons has also not been reported.

China has increased energy supply capacity since the beginning of the open and reform policy, and the adding capacity was soared in the latter half of 2000's. But the supply ability seems becoming excess already.

The following chart shows quarterly basis secondary sector industry gross domestic product and oil equivalent energy supply (crude oil processing and electricity output).

Sharp rises of GDP in the 4Q 2010 and 4Q 2011 compared to mild growth of energy supply suggest the cause of severe petroleum shortage in these periods.

Slight mismatch was also seen in 2Q this year due to the year-on-year decrease of crude oil processing during the period, but the market did not cause turmoil then.

Chinese refiners processed average 9.3 million barrels per day of crude oil during January-September this year, according to the National Bureau of Statistics. Refinery operating rates was estimated below 80%.

Chinese refineries kept their utilization rates relatively lower over the past couple of years because of unfavourable refining margins. However, the refining margin is recovering this year since the government has adjusted local petroleum prices more frequently.

Therefore, the slump in crude oil processing seemed to be caused by weak demand.

Year-on-year growth of Chinese industrial utilization rates has been below 10% since April.

China's crude oil processing capacity surged 44% between 2005 and 2010. Another 10% increase is estimated between 2010 and 2015 and further 16% growth is expected in the next five years after 2015.

But excess capacity could weigh on refiners operating costs if growth of demand is slowing.

However, similar supply disruption has not heard this year. Significant shortage of electricity supply capacity during demand seasons has also not been reported.

China has increased energy supply capacity since the beginning of the open and reform policy, and the adding capacity was soared in the latter half of 2000's. But the supply ability seems becoming excess already.

The following chart shows quarterly basis secondary sector industry gross domestic product and oil equivalent energy supply (crude oil processing and electricity output).

Sharp rises of GDP in the 4Q 2010 and 4Q 2011 compared to mild growth of energy supply suggest the cause of severe petroleum shortage in these periods.

Slight mismatch was also seen in 2Q this year due to the year-on-year decrease of crude oil processing during the period, but the market did not cause turmoil then.

Chinese refiners processed average 9.3 million barrels per day of crude oil during January-September this year, according to the National Bureau of Statistics. Refinery operating rates was estimated below 80%.

Chinese refineries kept their utilization rates relatively lower over the past couple of years because of unfavourable refining margins. However, the refining margin is recovering this year since the government has adjusted local petroleum prices more frequently.

Therefore, the slump in crude oil processing seemed to be caused by weak demand.

Year-on-year growth of Chinese industrial utilization rates has been below 10% since April.

China's crude oil processing capacity surged 44% between 2005 and 2010. Another 10% increase is estimated between 2010 and 2015 and further 16% growth is expected in the next five years after 2015.

But excess capacity could weigh on refiners operating costs if growth of demand is slowing.

10.28.2012

Is Asia energy demand recovering?

Crude oil market is under the pressure currently because bearish forecasts about the global economy give negative prediction to the energy consumption.

However, recent data on Asian oil demand show some recovery. It seems to suggest that the growth of regional energy use is bottoming out.

India's crude oil throughput in September rose 11.4% from a year ago to 3.45 million barrels per day, according to the Ministry of Petroleum and Natural Gas. It was the biggest year-on-year growth since July 2010.

Chinese crude oil throughput also soared by 7.0% on year to 9.47 million bpd in September, according to the National Bureau of Statistics. The nation's growth rates of crude oil processing had been less than 2% or negative figures over the past several months.

Japan has recorded year-on-year decrease of crude oil throughput during July and September, but weekly data by the Petroleum Association of Japan show 1.3% gains in the first 20 days in October.

Petroleum data describe that Asian demand is rebounding from the previous downward tendency. But we need to see another key data, electricity output.

Indian electricity output in September rose 3.7% on year to 73.1 billion kilowatt-hour, according to the Ministry of Power. Only India continues positive growth of monthly power generation among Asian three large countries over the past few years.

Meanwhile, China's electricity generation in September stood at only 1.2% growth, and Japan's power output fell 0.4% on year in the month due to the nationwide power saving following the nuclear power outage.

The growth of electricity generation seems to remain in the slow down tendency.

The Indian higher crude oil demand was likely caused by on-site generation to make up for a lack of electricity supply. China's increased crude oil processing in September might be related to the raise of domestic official petroleum prices. Lower products stock caused by dealers' hoarding before price increase and better refinery margins encouraged Chinese refiners to increase their operating rates.

We may have to wait an another 2-3 months before confirming whether Asian energy demand has finished the weak trend.

However, recent data on Asian oil demand show some recovery. It seems to suggest that the growth of regional energy use is bottoming out.

India's crude oil throughput in September rose 11.4% from a year ago to 3.45 million barrels per day, according to the Ministry of Petroleum and Natural Gas. It was the biggest year-on-year growth since July 2010.

Chinese crude oil throughput also soared by 7.0% on year to 9.47 million bpd in September, according to the National Bureau of Statistics. The nation's growth rates of crude oil processing had been less than 2% or negative figures over the past several months.

Japan has recorded year-on-year decrease of crude oil throughput during July and September, but weekly data by the Petroleum Association of Japan show 1.3% gains in the first 20 days in October.

Petroleum data describe that Asian demand is rebounding from the previous downward tendency. But we need to see another key data, electricity output.

Indian electricity output in September rose 3.7% on year to 73.1 billion kilowatt-hour, according to the Ministry of Power. Only India continues positive growth of monthly power generation among Asian three large countries over the past few years.

Meanwhile, China's electricity generation in September stood at only 1.2% growth, and Japan's power output fell 0.4% on year in the month due to the nationwide power saving following the nuclear power outage.

The growth of electricity generation seems to remain in the slow down tendency.

The Indian higher crude oil demand was likely caused by on-site generation to make up for a lack of electricity supply. China's increased crude oil processing in September might be related to the raise of domestic official petroleum prices. Lower products stock caused by dealers' hoarding before price increase and better refinery margins encouraged Chinese refiners to increase their operating rates.

We may have to wait an another 2-3 months before confirming whether Asian energy demand has finished the weak trend.

10.22.2012

NYMEX to become more local oil market

Brent's premium to WTI prices is increasing. Since NYMEX WTI crude oil prices are losing close relationship with global situations, NYMEX seems to be going to become a more local market.

The WTI crude oil prices should be higher than Brent due to its high grade, however, the American standard prices have been usually cheaper than Brent over the past couple of years.

Crude oil stocks at Cushing, Oklahoma used to have major impact to WTI crude oil prices, because NYMEX crude oil futures contracts are finally settled by physical delivery at Cushing. It has made some people to doubt the WTI's validity as an indicator price.

Therefore, some market participants recently use brent prices as the market indicator rather than WTI. Investment banks are also using Brent prices for their price forecasts.

The Brent/WTI price difference had close correlation with Cushing crude oil stocks until 2009, but the relationship has significantly changed in 2011.

Tensions in Middle East has been the major factor to decide the price differentials rather than the US inventories. Arabian Spring and Libyan civil war widen the Brent/WTI prices last year, then Iran's nuclear program and Syria-Turkey tension are supporting the recent steady premium.

On the other hand, Cushing crude oil inventory became to be able to carry to the Gulf of Mexico area after beginning of the reverse operations at the Seaway pipeline in May this year. The US Midwest crude stocks are no longer to be dead-end.

The Brent/WTI differential previously had been affected by the US domestic inventory level, but now it is largely swayed by the Middle Eastern geopolitical situation.

Middle Eastern tension is losing its influence to the United States because the US reduces crude oil imports due to increasing domestic production.

Meanwhile, the Middle Eastern situation that stimulates the Brent market also affects on Asian nations' crude oil imports significantly.

Brent prices' reaction against the Middle East tension seems not excessive, rather it is more critical that WTI prices are weakening relationship with international affairs.

The WTI crude oil prices should be higher than Brent due to its high grade, however, the American standard prices have been usually cheaper than Brent over the past couple of years.

Crude oil stocks at Cushing, Oklahoma used to have major impact to WTI crude oil prices, because NYMEX crude oil futures contracts are finally settled by physical delivery at Cushing. It has made some people to doubt the WTI's validity as an indicator price.

Therefore, some market participants recently use brent prices as the market indicator rather than WTI. Investment banks are also using Brent prices for their price forecasts.

The Brent/WTI price difference had close correlation with Cushing crude oil stocks until 2009, but the relationship has significantly changed in 2011.

Tensions in Middle East has been the major factor to decide the price differentials rather than the US inventories. Arabian Spring and Libyan civil war widen the Brent/WTI prices last year, then Iran's nuclear program and Syria-Turkey tension are supporting the recent steady premium.

On the other hand, Cushing crude oil inventory became to be able to carry to the Gulf of Mexico area after beginning of the reverse operations at the Seaway pipeline in May this year. The US Midwest crude stocks are no longer to be dead-end.

The Brent/WTI differential previously had been affected by the US domestic inventory level, but now it is largely swayed by the Middle Eastern geopolitical situation.

Middle Eastern tension is losing its influence to the United States because the US reduces crude oil imports due to increasing domestic production.

Meanwhile, the Middle Eastern situation that stimulates the Brent market also affects on Asian nations' crude oil imports significantly.

Brent prices' reaction against the Middle East tension seems not excessive, rather it is more critical that WTI prices are weakening relationship with international affairs.

10.14.2012

China's energy use shows further slump in September

Chinese September energy related economic statistics are showing slump.

China's crude oil import in September fell 2.2% from a year ago to 20 million tonnes or 4.9 million barrels per day, according to the General Administration of Customs. It was an another year-on-year decrease following August.

China was estimated increasing extra crude oil to fill the new strategic petroleum reserve facilities during the first half of this year. After completing the stockpile, crude oil imports for real demand show such sluggish figures.

Crude oil imports in the China in the first nine months rose 5.5% on year to 200 million tonnes, according to the customs data. However, the growth rate would be only 0.6%, if deduct the 80 millions barrel of strategic reserve amount from the total number.

On the other hand, State Electricity Regulatory Commission announced that China's electricity supply in September was 394.5 billion kilowatt-hour, rose only 2.2% from a year earlier.

The SERC's data showed the country's power supply increased 5.5% during first 6 months in this year to 2.37 trillion kWh, then rose 4.5% on year to 45.4 billion kWh in July and up 3.6% from a year ago to 44.5 billion kWh in August.

China's year-on-year growth of power supply was two digits last year. The growth of the electricity demand is apparently slowing down month by month.

Meanwhile, the sluggish tendency did not accelerate in September. It suggests the nationwide anti-Japan campaign did not affect entire Chinese industry significantly.

China's crude oil import in September fell 2.2% from a year ago to 20 million tonnes or 4.9 million barrels per day, according to the General Administration of Customs. It was an another year-on-year decrease following August.

China was estimated increasing extra crude oil to fill the new strategic petroleum reserve facilities during the first half of this year. After completing the stockpile, crude oil imports for real demand show such sluggish figures.

Crude oil imports in the China in the first nine months rose 5.5% on year to 200 million tonnes, according to the customs data. However, the growth rate would be only 0.6%, if deduct the 80 millions barrel of strategic reserve amount from the total number.

On the other hand, State Electricity Regulatory Commission announced that China's electricity supply in September was 394.5 billion kilowatt-hour, rose only 2.2% from a year earlier.

The SERC's data showed the country's power supply increased 5.5% during first 6 months in this year to 2.37 trillion kWh, then rose 4.5% on year to 45.4 billion kWh in July and up 3.6% from a year ago to 44.5 billion kWh in August.

China's year-on-year growth of power supply was two digits last year. The growth of the electricity demand is apparently slowing down month by month.

Meanwhile, the sluggish tendency did not accelerate in September. It suggests the nationwide anti-Japan campaign did not affect entire Chinese industry significantly.

10.07.2012

Dull exports lead China firms compete in limited local market

Chinese government recently announced to encourage exporting firms to develop domestic sales channel due to slump of processing trade activities.

However, current energy consumption figures in China suggest that the domestic market is not enough active to absorb supply from exporting companies.

Chinese processing trade companies are located in the bonded area. They import parts and materials from overseas without tariff, and their products are basically exported. Those companies have contributed China to earn huge amount of foreign currencies since the reform and open policy.

Processing trade companies should be licensed from the government when they wish to sell their products directly into the domestic market.

Chinese government deregulated the rule of domestic sales license for part of excellent processing trade firms in 2009 following the severe slump of exports due to the Lehman shock. This time, general processing trade companies are also encouraged to develop domestic markets.

China's processing trade amounts were 112.6 billion US dollars in August, according to the General Administration of Customs. It was 2.2% lower than the same month a year ago. Processing trade had already recorded year-on-year decrease in July.

Chinese processing trade had grown by two digits except for the slump period after the Lehman shock, but the growth rate has faded since 3Q 2011 after the Chinese yuan became stronger than the $1=6.4 yuan level.

Japan's exports, that is the typical supply source for the Chinese processing trade, also peaked out in late 2010. Although Japanese exports had strongly correlated with Chinese exports, those two numbers has been deviating especially after the Japan's severe earthquake in March 2011.

While growth of processing trade is fading, China's total exports continue moderate growth due to the relatively firmer general trades. Some people believe that the growth of general trades suggests that Chinese industrial activities are shifting from the subcontract of foreign companies to mature local industry. Those people anticipate consumption of the domestic Chinese people is also growing.

However, the growth of energy consumption apparently shows actual slowdown of industrial activities in China. Growth of exports including the general trades is also under the shrinking tendency.

If Chinese domestic demand is expanding despite the sluggish growth of exports, energy consumption is likely to maintain steady growth. Therefore, it is natural to think the Chinese domestic demand is not strong enough at moment.

If many exporting companies rush into the limited domestic markets, intense competition with local firms might hurt strength of the entire Chinese manufacturers.

However, current energy consumption figures in China suggest that the domestic market is not enough active to absorb supply from exporting companies.

Chinese processing trade companies are located in the bonded area. They import parts and materials from overseas without tariff, and their products are basically exported. Those companies have contributed China to earn huge amount of foreign currencies since the reform and open policy.

Processing trade companies should be licensed from the government when they wish to sell their products directly into the domestic market.

Chinese government deregulated the rule of domestic sales license for part of excellent processing trade firms in 2009 following the severe slump of exports due to the Lehman shock. This time, general processing trade companies are also encouraged to develop domestic markets.

China's processing trade amounts were 112.6 billion US dollars in August, according to the General Administration of Customs. It was 2.2% lower than the same month a year ago. Processing trade had already recorded year-on-year decrease in July.

Chinese processing trade had grown by two digits except for the slump period after the Lehman shock, but the growth rate has faded since 3Q 2011 after the Chinese yuan became stronger than the $1=6.4 yuan level.

Japan's exports, that is the typical supply source for the Chinese processing trade, also peaked out in late 2010. Although Japanese exports had strongly correlated with Chinese exports, those two numbers has been deviating especially after the Japan's severe earthquake in March 2011.

While growth of processing trade is fading, China's total exports continue moderate growth due to the relatively firmer general trades. Some people believe that the growth of general trades suggests that Chinese industrial activities are shifting from the subcontract of foreign companies to mature local industry. Those people anticipate consumption of the domestic Chinese people is also growing.

However, the growth of energy consumption apparently shows actual slowdown of industrial activities in China. Growth of exports including the general trades is also under the shrinking tendency.

If Chinese domestic demand is expanding despite the sluggish growth of exports, energy consumption is likely to maintain steady growth. Therefore, it is natural to think the Chinese domestic demand is not strong enough at moment.

If many exporting companies rush into the limited domestic markets, intense competition with local firms might hurt strength of the entire Chinese manufacturers.

9.30.2012

Disputes not affect Sino-Japan trades?

Because the dispute between China and Japan over the Senkaku islands in East China Sea, many people have concerned about regional trade activities. Daiwa Institute of Research recently announced a report saying the dispute is likely to reduce Japan's exports to China this year by about 1 trillion yen ($12.8 billion).

However, Japanese exports to China has decreased from a year ago level since 2Q 2011. Accumulated amounts in the first eight months in this year fell 9.2% from the same period a year earlier. Japan's exports to China in 2012 are likely to loose more than 1 trillion yen from the previous year even if there is no friction.

If Daiwa Institute predicts that the disputes cause another 1 trillion yen of reduction adding to the original decrease over the past year, Japan's exports to China will fall 16% from a year ago in 2012.

Japan is mainly exporting materials, parts and machineries to China to support Chinese industrial activities. Therefore, the 16% decrease of supply from Japan will cause significant limitation over Chinese manufacturing.

China seems to try to hide its rapid decrease of demand for materials and machineries using the friction with Japan.

The below chart shows the monthly year-on-year changes of China's energy demand and Japan's exports to China.

Growth of petroleum demand has been sluggish since the latter half of last year, and growth of electricity demand has been approaching to zero.

Since the slowdown of energy consumption represents sluggish manufacturing activities, demand for Japanese materials and parts is also declining.

The apparent oil demand, which is thought as the Chinese domestic pure demand calculated by Platts, shows more clear tendency of lowered growth of Chinese petroleum demand.

China's crude oil imports seemed to keep upward trend until mid-2012, but the import figures in the first half of this year contained stockpile for the newly build 80 million barrels of strategic reserve facilities.

Then, imports in July and August decreased apparently, and suggest fewer crude oil processing in the following months.

Even if both nations didn't have frictions, Japan's exports to China could have been likely to drop sharply after September.

However, Japanese exports to China has decreased from a year ago level since 2Q 2011. Accumulated amounts in the first eight months in this year fell 9.2% from the same period a year earlier. Japan's exports to China in 2012 are likely to loose more than 1 trillion yen from the previous year even if there is no friction.

If Daiwa Institute predicts that the disputes cause another 1 trillion yen of reduction adding to the original decrease over the past year, Japan's exports to China will fall 16% from a year ago in 2012.

Japan is mainly exporting materials, parts and machineries to China to support Chinese industrial activities. Therefore, the 16% decrease of supply from Japan will cause significant limitation over Chinese manufacturing.

China seems to try to hide its rapid decrease of demand for materials and machineries using the friction with Japan.

The below chart shows the monthly year-on-year changes of China's energy demand and Japan's exports to China.

Growth of petroleum demand has been sluggish since the latter half of last year, and growth of electricity demand has been approaching to zero.

Since the slowdown of energy consumption represents sluggish manufacturing activities, demand for Japanese materials and parts is also declining.

The apparent oil demand, which is thought as the Chinese domestic pure demand calculated by Platts, shows more clear tendency of lowered growth of Chinese petroleum demand.

China's crude oil imports seemed to keep upward trend until mid-2012, but the import figures in the first half of this year contained stockpile for the newly build 80 million barrels of strategic reserve facilities.

Then, imports in July and August decreased apparently, and suggest fewer crude oil processing in the following months.

Even if both nations didn't have frictions, Japan's exports to China could have been likely to drop sharply after September.

9.23.2012

Can we believe recovery of Iranian oil exports?

Recently, crude oil exports from Iran are reported to rebound. Is it meaning a change of situation?

Iran's crude oil exports have decreased significantly since July when sanctions by the European Union were invoked. The sanctions inhibit European nations to import Iranian crude oil and do not allow European insurance companies to underwrite marine insurance for tankers that carry Iranian crude oil toward any regions. Therefore, Iran's crude oil export was estimated to decline below the 1 million barrels per day level in July from above 2 million bpd level.

However, some alternatives against insurance by European companies are said to re-activate Iranian crude oil export.

Japan and India have decided to set the sovereign insurance for tankers to import Iranian crude oil. Although Japan's Iranian crude oil imports recorded zero in July, it seems to resume in August.

South Korea, which ceased to buy Iranian crude oil in July, also resumed purchase in September. The country uses insurance provided by Iran.

Marine insurance provided by Iran seems to recall some buyers who were worry about the risk on uninsured transportation.

On the other hand, It is expected that financial sanctions by the United States to deter buyers expansion of Iranian crude oil imports.

The U.S. has decided to sanction against financial institutes of countries that trade with Iran. But the sanction can be exempted for 6 month if the country reduce crude oil imports from Iran significantly.

Japan was approved the first exemption in March and another 6 months extension was given in September.

Meanwhile, China and India won the first exemption in June and another 6 months extension could be decided by the end of December.

It is unclear whether the U.S. will give these nations another exemption or not if they resume large Iranian oil imports.

About China, there is an another concern whether the country needs further Iranian oil or not.

China imported average 560,000 bpd of Iranian crude oil in 2011. But the numbers declined to about 350,000 bpd in the first quarter this year due to conflict over price negotiation.

Although the nation's Iranian oil imports rebounded to 520,000 bpd in the second quarter, decreased again to 460,000 bpd in July and 370,000 bpd in August. The August figure fell 22% from a year ago.

The decline in the third quarter was not only affected by the insurance problem, but also was caused by the sluggish demand.

China's total crude oil imports in August decreased 12.5% on year to 4.35 million bpd. It was the lowest level since October 2010.

China's accumulated crude oil imports during the first eight months in 2012 rose 7.4% from a year ago to 180 million tonnes. However, China has completed construction of 80 million barrels of national petroleum reserve facilities in early this year and started filling.

If the stockpile oil is deducted from total imports, net crude oil imports by China rose by only 0.7% on year in the Jan-Aug period. The real import number is match with the fact that the growth rate of crude oil processing during January and August stayed at 1.6% on year and the domestic crude oil production in the same period fell 0.4% from a year ago.

Then, recent economic data suggest that the growth of Chinese crude oil demand is likely to shrink further. China seems not necessary to buy more Iranian crude oil in spite of the risk of suffering financial sanctions.

Iran's crude oil exports have decreased significantly since July when sanctions by the European Union were invoked. The sanctions inhibit European nations to import Iranian crude oil and do not allow European insurance companies to underwrite marine insurance for tankers that carry Iranian crude oil toward any regions. Therefore, Iran's crude oil export was estimated to decline below the 1 million barrels per day level in July from above 2 million bpd level.

However, some alternatives against insurance by European companies are said to re-activate Iranian crude oil export.

Japan and India have decided to set the sovereign insurance for tankers to import Iranian crude oil. Although Japan's Iranian crude oil imports recorded zero in July, it seems to resume in August.

South Korea, which ceased to buy Iranian crude oil in July, also resumed purchase in September. The country uses insurance provided by Iran.

Marine insurance provided by Iran seems to recall some buyers who were worry about the risk on uninsured transportation.

On the other hand, It is expected that financial sanctions by the United States to deter buyers expansion of Iranian crude oil imports.

The U.S. has decided to sanction against financial institutes of countries that trade with Iran. But the sanction can be exempted for 6 month if the country reduce crude oil imports from Iran significantly.

Japan was approved the first exemption in March and another 6 months extension was given in September.

Meanwhile, China and India won the first exemption in June and another 6 months extension could be decided by the end of December.

It is unclear whether the U.S. will give these nations another exemption or not if they resume large Iranian oil imports.

About China, there is an another concern whether the country needs further Iranian oil or not.

China imported average 560,000 bpd of Iranian crude oil in 2011. But the numbers declined to about 350,000 bpd in the first quarter this year due to conflict over price negotiation.

Although the nation's Iranian oil imports rebounded to 520,000 bpd in the second quarter, decreased again to 460,000 bpd in July and 370,000 bpd in August. The August figure fell 22% from a year ago.

The decline in the third quarter was not only affected by the insurance problem, but also was caused by the sluggish demand.

China's total crude oil imports in August decreased 12.5% on year to 4.35 million bpd. It was the lowest level since October 2010.

China's accumulated crude oil imports during the first eight months in 2012 rose 7.4% from a year ago to 180 million tonnes. However, China has completed construction of 80 million barrels of national petroleum reserve facilities in early this year and started filling.

If the stockpile oil is deducted from total imports, net crude oil imports by China rose by only 0.7% on year in the Jan-Aug period. The real import number is match with the fact that the growth rate of crude oil processing during January and August stayed at 1.6% on year and the domestic crude oil production in the same period fell 0.4% from a year ago.

Then, recent economic data suggest that the growth of Chinese crude oil demand is likely to shrink further. China seems not necessary to buy more Iranian crude oil in spite of the risk of suffering financial sanctions.

9.16.2012

Mideast tensions rather to stabilize crude oil supply

Many market participants are afraid about that tensions in the middle east caused by anti-Islam film may threaten crude oil supply.

Does the turmoil actually affect on crude oil supply seriously?

Libyan civil war caused crude oil supply disruption last year. The war cut the country's crude oil production from the previous 1.6 million barrels per day to zero. WTI crude oil prices surged from around $80/bbl to above $110/bbl following the disruption.

Libyan crude oil output, however, rebounded rapidly after the cease of the civil war. Although battles spread over whole countries, damages on oil related facilities were much smaller than expected.

Similar situations were seen during the Iraq War a decade ago. Crude oil production resumed immediately after the end of major combat operations. Iraqi crude oil production recovered the nearly same level with pre-war level within less than half year despite continuing minor battles in the nation.

Why severe supply disruption can be caused by demonstrations and riots in urban areas, despite oil output facilities are not damaged even during war?

Political stability of countries being democratized by the Arab Spring movements in last year has been lowered. Combined governments are easy to be affected by extremists. It is difficult for those governments to control turmoil.

Demonstrations for democratization were seen even in Persian Gulf oil producing nations, and protest activities against the anti-Islam film also occur there.

But unstable situations in Libya and Egypt and the dire situation in Syria, where turmoil and civil war have continued since early last year without intervention by international society, seem to calm down people's enthusiasm against democracy in Arab oil producing countries such as Saudi Arabia.

Democratization does not bring better results, people are likely to recognize that it causes deteriorated public security and spread of terrorism.

Therefore, current turmoil in the middle east may suppress democratization movements in regional oil producing countries. It seems to stabilize crude oil supply from the area as a result.

Does the turmoil actually affect on crude oil supply seriously?

Libyan civil war caused crude oil supply disruption last year. The war cut the country's crude oil production from the previous 1.6 million barrels per day to zero. WTI crude oil prices surged from around $80/bbl to above $110/bbl following the disruption.

Libyan crude oil output, however, rebounded rapidly after the cease of the civil war. Although battles spread over whole countries, damages on oil related facilities were much smaller than expected.

Similar situations were seen during the Iraq War a decade ago. Crude oil production resumed immediately after the end of major combat operations. Iraqi crude oil production recovered the nearly same level with pre-war level within less than half year despite continuing minor battles in the nation.

Why severe supply disruption can be caused by demonstrations and riots in urban areas, despite oil output facilities are not damaged even during war?

Political stability of countries being democratized by the Arab Spring movements in last year has been lowered. Combined governments are easy to be affected by extremists. It is difficult for those governments to control turmoil.

Demonstrations for democratization were seen even in Persian Gulf oil producing nations, and protest activities against the anti-Islam film also occur there.

But unstable situations in Libya and Egypt and the dire situation in Syria, where turmoil and civil war have continued since early last year without intervention by international society, seem to calm down people's enthusiasm against democracy in Arab oil producing countries such as Saudi Arabia.

Democratization does not bring better results, people are likely to recognize that it causes deteriorated public security and spread of terrorism.

Therefore, current turmoil in the middle east may suppress democratization movements in regional oil producing countries. It seems to stabilize crude oil supply from the area as a result.

9.02.2012

Japan gets over summer without nuclear power

Much heat waves and tropical nights boosted electricity consumption in Japan during August. Electric power supply in the Tokyo Metropolitan area rose 6.5% from a year ago to 27.5 billion kilowatthour.

However, the demand was lower by 12.5% compared to August 2010, when temperature was higher than this year, economy was recovering from the Lehman shock slump and no one was required power saving.

Electricity demand in western Japan's Kansai area around Osaka and Kyoto was also recorded highest in this year in August at 14.6 billion kWh. But a lack of nuclear power supply forced regional users to reduce electricity consumption. The August power demand was 2.5% lower from a year ago and decreased by 11.3% from the same month in 2010.